Press release 15/03/2024

ENVIRONMENTAL ACCOUNTS: ENVIRONMENTAL TAXES ACCOUNT. ADVANCE. 2022

Environmental taxes in the Basque Country amounted to 1,284 million euros in 2022

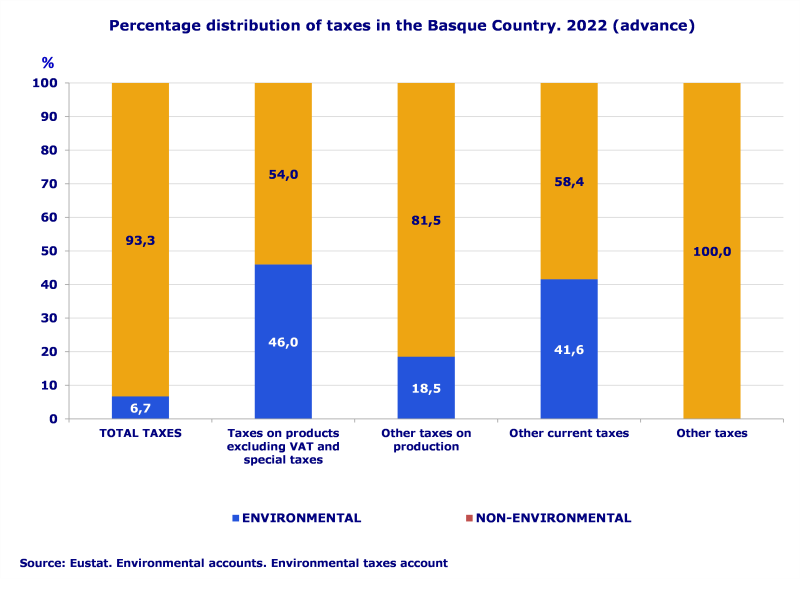

Environmental taxes accounted for 6.7% of all taxes in the Basque Country in 2022

Environmental taxes in the Basque Country constituted 1,284 million euros in 2022, 78 million lower than the previous year (-5.7%), corresponding to 1.5% of GDP, according to the Environmental Taxes Account prepared by Eustat.

This account is part of the Environmental Accounts System and is prepared following Eurostat methodology. Its framework comprises all taxes whose tax base is a physical unit (or a proxy of it) of something that has a proven, specific negative impact on the environment and which is defined in the European System of Accounts (SEC2010) as a tax.

With regard to total taxes in the Basque Country, environmental taxes represented 6.7% in 2022, one point lower than 2021.

Based on criteria of an environmental nature, environmental taxes are grouped into three categories: Energy taxes, Transport taxes and Taxes on pollution and resources.

Environmental Taxes in the Basque Country by environmental nature (thousand euros). 2018-2022

| | 2018 | 2019 | 2020 | 2021 | 2022(a) | Annual variation rate (%) |

| | | | | | | 2021/2020 | 2022(a)/2021 |

| TOTAL ENVIRONMENTAL TAXES | 1.256.231 | 1.370.226 | 1.196.441 | 1.361.714 | 1.284.051 | 13,8 | -5,7 |

| TAXES ON ENERGY | 1.081.959 | 1.194.254 | 1.030.639 | 1.193.145 | 1.104.650 | 15,8 | -7,4 |

| TAXES ON TRANSPORT | 163.503 | 164.902 | 154.250 | 157.433 | 163.871 | 2,1 | 4,1 |

| TAXES ON CONTAMINATION AND RESOURCES | 10.769 | 11.070 | 11.552 | 11.136 | 15.530 | -3,6 | 39,5 |

(a)Advanced data

Date March 15, 2024

Source:Eustat. Environmental accounts. Environmental taxes account

Of particular note was the decrease in revenue generated by Energy taxes, primarily as a result of the urgent regulatory measures adopted to moderate the rise in electricity prices

As regards the type of environmental taxes, firstly it is worth highlighting energy taxes as they account for the highest amount, 1,105 million in 2022, representing 86.0% of all environmental taxes. These were also the taxes that registered the sharpest decrease, 7.4% compared to 2021, a direct consequence of the evolution of the Special Hydrocarbon Tax, accounting for 925 million, which represented 83.8% of energy taxes and registered a drop of 7.7%, that is, 77 million lower than 2021.

In this group, the Special Hydrocarbon Tax is followed by Greenhouse Gas Emission Rights, at 140 million, up 51 million, which despite rising by 57.0% compared to 2021 due to a significant increase in average prices of emission rights (46.8%), do not offset the negative effect of other taxes in the group. The Energy Savings and Efficiency Plan Surcharge, at 12 million (-7.4%), and the CORES Resource, at 14 million (-1.4%), also form part of this group of taxes.

In the same group, the Tax on the Value of Electricity Production and the Special Tax on Electricity together accounted for a total of 13 million, a drop of 62 million, representing a decrease of 82.3% compared to 2021. This drop resulted from the set of emergency measures implemented to mitigate the impact of escalating prices on retail electricity markets. In addition, it is worth highlighting that there has been no revenue from Fees for Utilising Continental Waters for Electricity Production since 2021, due to the suspension of the Decree regulating them.

Secondly, transport taxes contributed 164 million euros in 2022, 4.1% higher than the previous year, representing 12.8% all taxes of an environmental nature. Of particular note in this category was the Tax on Mechanical Traction Vehicles, which, at 138 million euros in 2022, accounted for 84.5% of this group of taxes.

Lastly, taxes on pollution and resources contributed 1.2% of all environmental taxes, at 16 million euros, up 4 million, and rose 39.5% compared to the previous year. The increase in this group of taxes is mainly due to the Tax on Fluorinated Greenhouse Gases, which rose by 81.0%, 3 million higher than the previous year.

As regards classification by type of tax, the largest proportion of taxes of an environmental nature, 46.0%, were concentrated in Taxes on Products, Excluding VAT and Taxes on Imports; in 2022, the figure stood at 1,001 million, representing 77.9% of all environmental taxes, 5.1 points lower than 2021.

For their part, Other current taxes with an environmental purpose accounted for 41.6%, 1.4 points lower than 2021, amounting to 139 million euros. Lastly, in Other taxes on production, 18.5%, 6 points lower than 2021, corresponded to environmental taxes, with 145 million euros, an increase of 54.3% compared to 2021.

European comparative analysis of the environmental tax burden

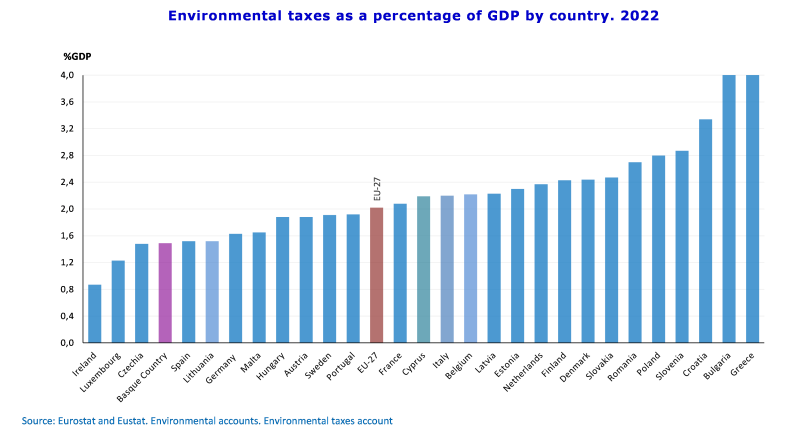

Green taxation, measured as the percentage of environmental taxes in GDP, was estimated at 1.5% in the Basque Country in 2022, below countries such as Denmark (2.4%), France (2.1%) and Germany (1.6%), but higher than Ireland (0.9%) and Luxembourg (1.2%) and similar to countries like Spain and Lithuania. The average for the EU27 was 2.0%. At the top of the table were countries such as Greece, Croatia and Bulgaria, with rates above 3%.

There was an overall decrease in environmental taxes as a percentage of GDP in most EU-27 Member States in 2022 compared to 2021, with exceptions such as Bulgaria, Romania and Greece.

Analysis by activity branch and household

Households contributed 46.8% of all environmental taxes. By type of taxes, they contributed 78.1% of Transportation Taxes and 42.7% of Energy Taxes.

As regards activity branches, they accounted for 53.2% of all Environmental Taxes, and in terms of type, it is worth highlighting that 57.3% of the total came from Energy Taxes and 21.9% from Transport Taxes.

In turn, the branch corresponding to Trade, Hospitality and Transport as a whole contributed 35.9% of the total, followed by the Manufacturing Industry with 15.4%.

Environmental taxes of the Basque Country by branches of activity and households (thousand euros). 2022

| | 2022(a) | % |

| AGRICULTURE, FORESTRY AND FISHERIES | 5.111 | 0,4 |

| INDUSTRY AND ENERGY | 278.445 | 21,7 |

| Manufacturing industry | 197.926 | 15,4 |

| Energy | 80.519 | 6,3 |

| CONSTRUCTION | 21.790 | 1,7 |

| SERVICES | 377.131 | 29,4 |

| Trade, accommodation & food services and transport | 306.806 | 23,9 |

| Public administration, education, human health and social work activities | 44.559 | 3,5 |

| -Rest of services | 25.766 | 2,0 |

| HOUSEHOLDS | 600.244 | 46,8 |

| TOTAL | 1.282.721 | 100,0 |

(a)Advanced data

Date March 15, 2024

Source:Eustat. Environmental accounts. Environmental taxes account

Provincial analysis of Environmental Taxes

The distribution of environmental taxes by province for 2022 reveals that Bizkaia accumulated 56.1% of the total, Gipuzkoa 29.8% and Álava the remaining 14.1%.

In addition, although the drop in environmental taxes in 2022 for the Basque Country stood at 5.7%, it is worth highlighting Gipuzkoa with a decrease of 12.3% compared to 2021, followed by Álava, 10.6% lower, and Bizkaia with -0.3%.

Environmental Taxes in the Basque Country by province (thousand euros). 2019-2022

| | 2019 | 2020 | 2021 | 2022(a) | Annual variation rate (%) |

| | | | | | 2020/2019 | 2021/2020 | 2022(a)/2021 |

| BASQUE COUNTRY | 1.370.226 | 1.196.441 | 1.361.714 | 1.284.051 | -12,7 | 13,8 | -5,7 |

| ARABA/ALAVA | 207.754 | 192.772 | 202.054 | 180.713 | -7,2 | 4,8 | -10,6 |

| BIZKAIA | 712.009 | 622.404 | 723.217 | 720.751 | -12,6 | 16,2 | -0,3 |

| GIPUZKOA | 450.463 | 381.265 | 436.443 | 382.587 | -15,4 | 14,5 | -12,3 |

(a)Advanced data

Date March 15, 2024

Source:Eustat. Environmental accounts. Environmental taxes account

As regards environmental taxes in relation to the respective GDP, in Bizkaia they represented 1.6% in 2022, while in both Álava and Gipuzkoa, they accounted for 1.4% in 2022.

For further information:

Eustat - Euskal Estatistika Erakundea / Basque Statistics Institute

C/ Donostia-San Sebastián, 1 01010 Vitoria-Gasteiz

Press Service: servicioprensa@eustat.eus Tel.: 945 01 75 62