Press Release 29/10/2009

EQUITY ACCOUNTS OF NON-FINANCIAL COMPANIES (CPENF) 2007

47% of the assets of non-financial companies belonged to the industrial sector

38% of the business equity was located in micro-companies, which accounted for 42% of the total number of employed people

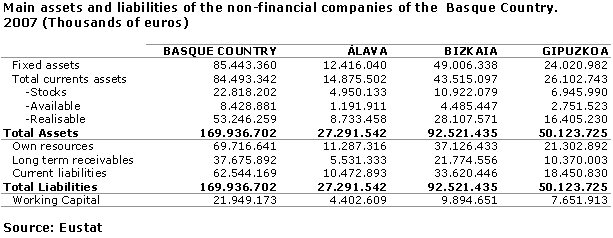

Estimated equity for all non-financial companies of the Basque Country stood at 169,938 million euros, 47% of which belonged to the industrial sector. The other assets were distributed between the 44% of the service sector and the 9% of the construction sector, according to Eustat data. Non-financial companies in these three sectors employed 818,299 people in the Basque Country, 80.6% of the total number of people employed in 2007.

The classification of the equity between the different employment brackets confirmed that large companies (over 250 employees were the most capital intensive. Therefore, we see that while micro-companies (1-9 employees), small (10-49 employees) and medium-size (50-249) companies accounted for 88% of people employed, these three brackets only held 76% of the assets. On the other hand, large companies that accounted for 12% of the number of people employed held 24% of the total assets of the economy.

�

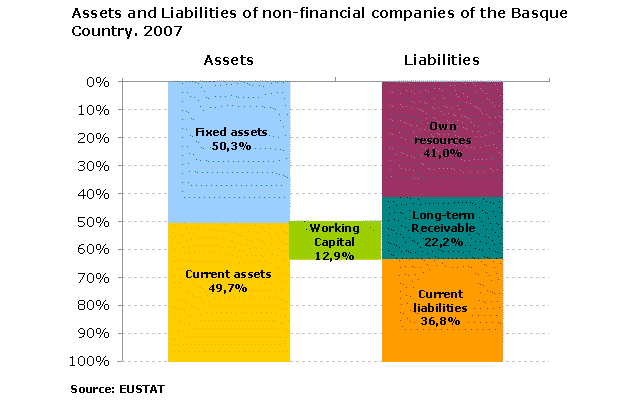

As regards the weight of the different entries in the Assets of the balance sheet, Fixed Assets accounted for 50.3% of the total while Current Assets came to 49.7%. Under the headings included in fixed assets, most notable in terms of importance was Tangible Fixed Assets, which came to 52% and Financial Investments, with 39%. There were also two items that stood out under Current Assets: Debtors, that accounted for 47% of the total and Stock with 27%.

If we turn out attention to the Liabilities side of the balance sheet, the three most important accounts were Own Resources, with 41.0% of the total, Current Liabilities, with 36.8% and Long-term receivables, 22.2%. Within Own Resources, two entries stand out; Reserves, which came to 40% and Subscribed Capital, with 32%.

In the analysis of the balance sheets, the Working Capital (difference between Current Assets and Current Liabilities) was positive, standing at 21,949 million euros, which meant that sufficient resources were generated to regularly deal with short-term debts (Short-term receivable liabilities

The Debt Ratio, the ratio that demonstrates the existing relationship between external funds and total resources, stood at 59.0% for the Basque Country, which was two presentable points down on the previous period. This ratio shows that nearly three-fifths of our assets were financed with external resources.

As for the economic return ratio, it stood at 7.2% and showed the average performance achieved by companies compared to its total assets. Financial return explains the average performance achieved by companies compared to its own funds, calculated at 13.6% for all the companies of the Basque Country. Both ratios stood at 6.8% and 13.7%, respectively, in 2006.

In the distribution of assets by sectors, the importance of industry was made clear within the economy of the Basque Country. Thus, we saw that 47% of assets corresponded to the industrial sector which had only 31% of employment, that construction had 9% of assets with 12% of employment and, finally, that market services accounted for 44% of the assets with 56% of employment

�

Important differences can be seen in the composition of company liabilities in the construction sector compared to those of industry and market services The construction sector had short-term debts of 53%, while the industrial sector came to 34% and the market services to 37%.

This uneven composition of liabilities was reflected in ratios such as total debt, which in the case of construction came to 70.2%, compared to 56.6% for industry and 59.2% for market services

As regards sector profitability, it can be seen that economic profitability was higher in industry (7.6%) and in services (6.9%) than in construction (6.9%) On the other hand, financial probability was higher in construction (18.4%) than in industry (13.3%) and in services (13.5%).

For further information:

Basque Statistics Office

C/ Donostia-San Sebastián, 1 01010 Vitoria-Gasteiz

Tlf:+34-945-01 75 00 Fax:+34-945-01 75 01 E-mail: eustat@eustat.es

Contact: Patxi Garrido

Tlf:+34-945-01 75 13 Fax:+34-945-01 75 01

Online press releases: www.eustat.es