Press release 16/10/2024

EQUITY ACCOUNTS OF NON-FINANCIAL COMPANIES 2022

The economic and financial profitability of non-financial companies in the Basque Country rose to record levels in 2022

The capacity of companies to meet their short-term debts decreased by 1.9% in 2022

In the Basque Country as a whole, the economic profitability of non-financial companies was 5.6% in 2022, while financial profitability stood at 9.5%, the best results since 2010, according to Eustat data.

These figures are up almost one and a half percentage points on those obtained in 2021 in the case of economic profitability, and as much as 2.5 points in the case of financial profitability.

The economic profitability ratio provides information on the effectiveness of the company's management. Higher values mean that fewer assets are required to achieve greater profits.

The highest economic profitability corresponded to large companies – over 249 staff – which, with a significant increase of 3.8 points compared to 2021, obtained a ratio of 7.5%, the highest in the available historical series. It is also worth highlighting the performance of small businesses – 10 to 49 employees – with a ratio of 5.9% in 2022. The economic profitability of micro-enterprises – 1 to 9 people – stood at 4.4%, close to the 4.8% achieved by medium-sized companies – with 50 to 249.

Focusing on sectors of economic activity, they all obtained positive economic profitability in 2022, most notably Telecommunications, 17.9%, Manufacture of pharmaceutical products, 10.9% and Healthcare activities, 9%. At the other end of the scale, the lowest profitability was recorded, again, by Research and development (0.1%) and Arts, recreation and entertainment activities (1.4%).

In the year-on-year trend, it is worth noting the positive performance of the sectors Telecommunications, Extraction industries, Electricity, gas, steam and air conditioning supply and Manufacture of transport equipment. The first and second of these had experienced negative ratios in 2021, -3.8% and -0.2%, respectively, which turned into ratios of 17.9% and 3.8% in 2022, following a spectacular one-year increase of 21.7 percentage points, in the case of Telecommunications, and 4 percentage points, in the case of Extractive industries. For their part, the Electricity, gas, steam and air conditioning supply and Manufacture of transport equipment sectors grew by 2.6 and 2.5 percentage points, respectively, in the last year, rising to 7.1% and 4.5%.

In 2022 financial profitability increased by 2.5 percentage points, standing at 9.5%. The financial profitability ratio reflects a company’s capacity to pay its owners or shareholders.

Taking company size into account, the pattern for financial profitability was similar, as small companies recorded profitability of 10.4% and large companies 13.9%, compared to a financial profitability of 6.7% for micro-enterprises and 8.8% for medium-sized companies. It is worth stressing the notable increase in this ratio for large companies, with a rise of 8 percentage points in just one year and, to a lesser extent, small companies, with 2.5 percentage points. Micro enterprises and medium-sized companies posted an increase of 0.2 percentage points each.

For this indicator, sector-level analysis revealed highly heterogeneous situations. Six sectors obtained financial profitability of more than 13%: Telecommunications, 47,4%, Manufacture of rubber, plastic and other non-metallic mineral products, 16,3%, Manufacture of pharmaceutical products, 15,2%, Chemical industry, 14,7%, Healthcare activities, 13,8% and Wholesale and retail trade; repair of motor vehicles and motorcycles, 13,6%.

A further group of seven sectors, belonging to a wide range of activities, had an average financial profitability of 10% or more: Manufacture of transport equipment, Manufacture of base metals and metal products, excluding machinery and equipment, Hospitality, Electricity, gas, steam and air conditioning supply, Timber, paper and graphic arts, Manufacture of Computer, Electronic & Optical Products and Manufacture of furniture; other manufacturing industries; repair and installation of machinery and equipment, with profitability between 12,8% and 10,2%.

The remaining activities registered below-average, but positive, profitability, except for the Research and development sector, which had negative financial returns, standing at -0.4%.

In 2022, current assets of non-financial companies grew by 7.2%, with a 3.2% increase in total assets

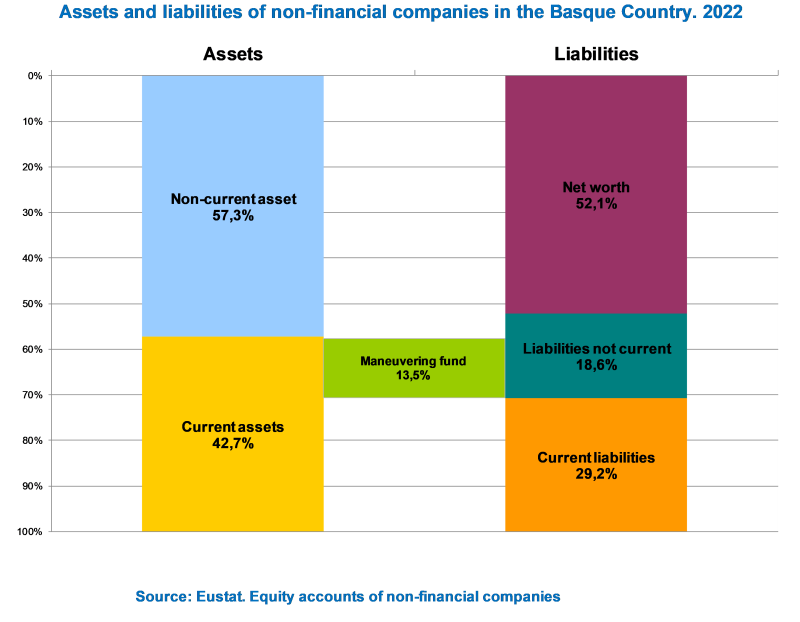

The analysis of the structure of assets and liabilities in the 2022 tax year provided more detailed information on non-financial companies in the Basque Country.

The accumulated asset value of non-financial Basque companies, with a total nominal value of 234,173 million euros, rose by 3.2% compared to 2021.

Fixed or non-current assets (resources that benefit the company in the long-term, such as intangible and tangible fixed assets, investments in property and group companies or long-term financial investments, among others) were the most significant group. They amounted to 134,112 million euros and represented 57.3% of total assets.

Current assets (company assets that can be liquidated, i.e. converted into cash, in less than twelve months) accounted for the remaining 42.7%, with 100,061 million euros. With this trend, fixed assets increased by 0.4% compared to 2021, while current or floating assets were up 7.2%. As a result of the combined trend in both stocks, total assets grew by 3.2% in relation to the previous year.

In turn, within liabilities and net equity as a whole, the share of own resources or net equity reached a total of 122,111 million euros and represented 52.1% in 2022, 3.3% higher than the figure recorded in 2021. Liabilities represent a company's financial obligations, while net equity is the total amount of financial resources available.

Short-term debts or current liabilities as a whole, with a total value of 68,428 million euros, amounted to 29.2%, registering a positive variation of 12.0% in the past year.

However, long-term debts or non-current liabilities, standing at 43,634 million, fell by 8.2% in the past year, accounting for 18.6% as a whole. Non-current liabilities consist of long-term debts and obligations, i.e. those with a maturity of more than one year.

The capacity of companies to meet their short-term debts, working capital, decreased by 1.9% in 2022

With these results, Working Capital, a company’s capacity to meet its short-term debts, which is calculated as the difference between current assets and current liabilities, was positive and stood at 31,633 million euros (13.5% of total assets), 1.9% lower than in 2021.

For further information:

Eustat - Euskal Estatistika Erakundea / Basque Statistics Institute

C/ Donostia-San Sebastián, 1 01010 Vitoria-Gasteiz

Press Service: servicioprensa@eustat.eus Tel.: 945 01 75 62