Press release 10/03/2023

ENVIRONMENTAL ACCOUNTS. ENVIRONMENTAL TAXES ACCOUNT. ADVANCE. 2021

Environmental taxes in the Basque Country rose by 13.9% in 2021 compared to the previous year

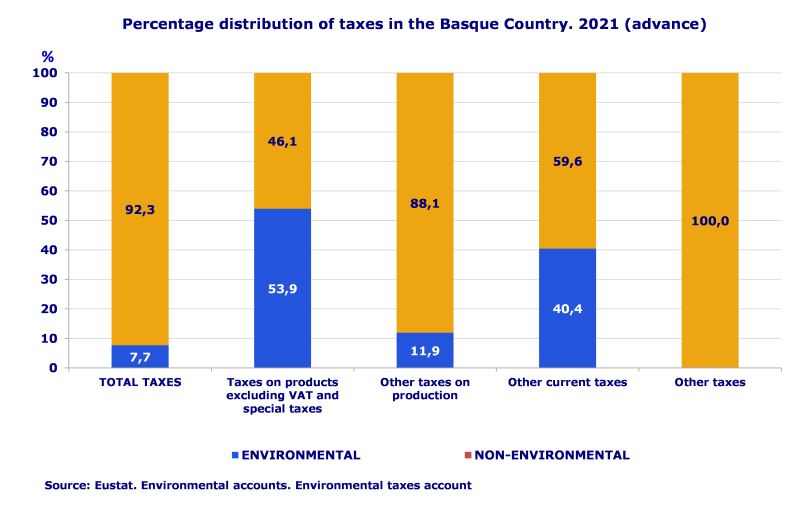

Environmental taxes in 2021 accounted for 7.7% of all taxes in the Basque Country

In 2021, environmental taxes in the Basque Country stood at 1,363 million euros, 167 million more than the previous year (+13.9%), which corresponded to 1.7% of GDP, according to the Environmental taxes account prepared by Eustat. With these data, figures reached similar levels to those recorded in 2019, before the economic and health effects of the pandemic.

This account is part of the system of environmental accounts and is prepared according to Eurostat's methodology. Its framework comprises all taxes whose tax base is a physical unit (or a proxy of it) of something that has a proven, specific negative impact on the environment and which is defined in the European System of Accounts (SEC2010) as a tax.

Based on criteria of an environmental nature, environmental taxes are grouped into three categories: Energy taxes, Transport taxes and Taxes on pollution and resources.

Environmental Taxes in the Basque Country by environmental nature (thousand euros). 2017-2021

| | 2017 | 2018 | 2019 | 2020 | 2021(a) | Annual variation rate (%) |

| | | | | | | 2020/2019 | 2021(a)/2020 |

| TOTAL ENVIRONMENTAL TAXES | 1.201.973 | 1.256.231 | 1.370.226 | 1.196.441 | 1.363.060 | -12,7 | 13,9 |

| TAXES ON ENERGY | 1.034.555 | 1.081.959 | 1.194.254 | 1.030.639 | 1.195.963 | -13,7 | 16,0 |

| TAXES ON TRANSPORT | 156.948 | 163.503 | 164.903 | 154.250 | 156.388 | -6,5 | 1,4 |

| TAXES ON CONTAMINATION AND RESOURCES | 10.470 | 10.769 | 11.070 | 11.552 | 10.709 | 4,4 | -7,3 |

(a)Advanced data

Date March 10, 2023

Source:Eustat. Environmental accounts. Environmental taxes account

Of particular note was the rise in income generated by Energy taxes, mainly due to the evolution of the Special hydrocarbon tax

As regards the nature of environmental taxes, energy taxes registered the highest amount, reaching 1,196 million in 2021, accounting for 87.7% of total environmental taxes, and they also saw the highest growth, up 16.0% on 2020. This rise was a direct consequence of the evolution of the special hydrocarbon tax, which, with 1,005 million, represented 84.0% of energy taxes and posted an increase of 18.9%, i.e. 160 million more than in 2020. It was followed in this group by greenhouse gas emission rights, which increased by 35.4% compared to 2020, due to the significant rise in average prices of emission rights.

Finally, taxes on the value of electricity production and the special tax on electricity reached a total of 75 million, which was a decrease of 16.1% in respect of 2020. This drop resulted from the set of emergency measures implemented to mitigate the impact of escalating prices on retail electricity markets. It is also worth pointing out that in 2021 there was no revenue from Fees for Utilising Continental Waters for Electricity Production, due to the suspension of the Decree regulating them, which was subject to legal appeals.

In second place, transport taxes contributed 156 million euros in 2021, which represented 11.5% of total taxes of an environmental nature, up 1.4% on the previous year. Of particular note in this category was the tax on mechanical traction vehicles, which, with 136 million euros in 2021, accounted for 87.2% of this group of taxes.

Lastly, taxes on pollution and resources contributed 0.8% of total taxes of an environmental nature, with 11 million euros and a decrease of 7.3% compared to the previous year.

As regards classification by type of tax, Taxes on products, excluding VAT and Taxes on imports not only saw the highest growth in environmental taxes (with a rise of 14.7%), but also accounted for the highest percentage of taxes of an environmental nature, with 53.9%. In 2021, the figure stood at 1,131 million, representing 83.1% of total environmental taxes.

As for Other current taxes with an environmental purpose, they accounted for 40.4%, reaching 137 million euros (-1.1%). Finally, within Other taxes on production, 11.9% corresponded to environmental taxes, with 94 million euros, an increase of 32.3% in relation to 2020.

European comparative analysis of the environmental tax burden

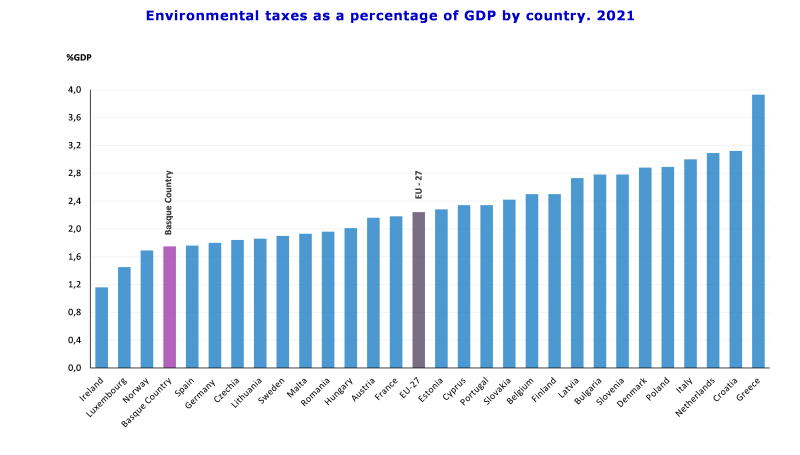

Green taxation, measured as a percentage of environmental tax revenue over GDP, stood at 1.7% in the Basque Country in 2021, below countries such as France (2.2%) and Sweden (1.9%), above Luxembourg (1.5%) and similar to countries such as Norway (1.7%) or Spain and Germany, both with 1.8%. The average for the EU27 was 2.2%. At the very top of the table were countries such as Greece, Croatia and the Netherlands, with rates above 3%.

Provincial analysis of Environmental Taxes

The distribution of environmental taxes by province for 2021 revealed that Bizkaia accumulated 52.7% of the total, Gipuzkoa 32.5% and Álava accounted for the remaining 14.8%.

Furthermore, although the general increase in taxes in 2021 was 13.9%, Gipuzkoa stood out with a rise of 16.1% compared to 2020, while in Bizkaia they were up 15.5% and in Álava 4.4%.

Environmental Taxes in the Basque Country by province (thousand euros). 2018-2021

| | 2018 | 2019 | 2020 | 2021(a) | Annual variation rate (%) |

| | | | | | 2019/2018 | 2020/2019 | 2021(a)/2020 |

| BASQUE COUNTRY | 1.256.231 | 1.370.226 | 1.196.441 | 1.363.060 | 9,1 | -12,7 | 13,9 |

| ARABA/ALAVA | 193.726 | 207.754 | 192.771 | 201.218 | 7,2 | -7,2 | 4,4 |

| BIZKAIA | 662.638 | 712.009 | 622.404 | 719.156 | 7,5 | -12,6 | 15,5 |

| GIPUZKOA | 399.867 | 450.463 | 381.266 | 442.686 | 12,7 | -15,4 | 16,1 |

(a)Advanced data

Date March 10, 2023

Source:Eustat. Environmental accounts. Environmental taxes account

For further information:

Eustat - Euskal Estatistika Erakundea / Basque Statistics Institute

C/ Donostia-San Sebastián, 1 01010 Vitoria-Gasteiz

Press Service: servicioprensa@eustat.eus Tel.: 945 01 75 62