Press Release 08/06/2022

SERVICES SURVEY. HOSPITALITY. 2020

After eight years of uninterrupted growth, the pandemic brought about a 47.4% drop in turnover for hospitality in the Basque Country in 2020

Other food services - catering, event catering, etc. - and other accommodation services - campsites, apartments, guest houses, etc. - experienced a more limited fall in turnover with numbers around 30% lower than in 2019

The Hospitality sector, which encompasses companies offering accommodation services and those that offer food and drink services, had a turnover of 2,371 million euros in 2020, 2,139 million lower than the 4,510 million registered in 2019, representing a reduction of 47.4%, almost half, in the Basque Country

In 2020 the Basque Hospitality sector employed 60,519 people in 13,523 establishments and, even though the adjustment in employment was limited to a drop of 5.6% and the number of establishments fell slightly (-1.4%), the other main economic variables also registered decreases that were similar to or greater than those for turnover.

As such, personnel costs fell by 43% and the gross value added at factor cost - which represents the wealth generated and is equivalent to the gross revenue from operating activities after adjustment for subsidies and indirect taxes - dropped by 52%. However, the result for the financial year was the least favourable indicator in 2020, as it ended in negative territory (74.3 million euros), -141.2% lower than in 2019, when in the immediately preceding years it had registered positive values far exceeding 180 million. The drop in the number of hours worked was more moderate, -28.8%.

Source: Eustat. Services survey

Period availables

Source: Eustat. Services survey

Period availables

Within Hospitality, the Food & Drink division, which in turn includes the sub-sectors of Restaurants, Other Food Services and Drinks Establishments, was dominant, accounting for 89.9% of establishments, 89.7% of employment and a similar proportion of turnover, 88.7%.

In 2020 its turnover shrank by just over 1,700 million to 2,104 million, representing a drop of 45.1%. Similarly, employment fell by 4.6% compared to 2019, a loss of 2,600 jobs, with a total of 54,256 persons employed in this division. 26.9% fewer hours were worked.

Despite this negative scenario, the Food & Drink division was able to end the year with a positive result, at over 4.4 million euros, even though it was 96.3% lower than the result for the previous year.

Analysing the results at a more disaggregated activity level and within the Food & Drink division, the most significant sub-sector is Restaurants. It represented 51.5% of the division’s total turnover and 45.4% of employment. Last year it registered a negative variation of 43.9% in turnover, and 4.3% in employment.

The Drinks Establishments sub-sector also performed negatively in turnover, -50.5%, and employment, -4.0%. It accounted for 36.1% of jobs and 35.1% of turnover in the sub-sector as a whole.

Lastly, Other food services, including catering, registered a reduction of 6.3% in persons employed, but in the case of turnover, the drop was comparatively lower than that of the two preceding groups, at -31.2%, which is the smallest fall in turnover in the entire hospitality sector. It accounted for 18.5% of employment and 13.4% of turnover in the Food & Drink division.

The Accommodation services division, comprising the Hotels and Other accommodation sub-sectors, was hit even harder than Food and beverage services by the consequences of the COVID-19 pandemic. In 2020 it had a turnover of slightly over 267 million euros, but this was 411 million less than in 2019, that is, 60.6% lower.

Employment in the division shrank by 13.4%, even though the number of establishments remained stable and even grew slightly, by 1.6%, primarily thanks to accommodation other than hotels (campsites, apartments, etc.), given that the figure for these remains unchanged.

Main variables of Hospitality sector of the Basque Country by activity group (thousands of euros). 2020

| | Establishments | Personnel employed | Turnover | Profit for the year |

| | Value | Annual variation (%) | Value | Annual variation (%) | Value | Annual variation (%) | Value | Annual variation (%) |

| HOSTELRY | 13.523 | -1,4 | 60.519 | -5,6 | 2.370.900 | -47,4 | -74.255 | -141,2 |

| | | | | | | | | |

| Accommodation services | 1.368 | 1,6 | 6.263 | -13,4 | 267.346 | -60,6 | -78.623 | -226,2 |

| Hotels | 630 | 0,0 | 4.682 | -16,7 | 195.582 | -65,9 | -75.270 | -249,1 |

| Other accommodation | 738 | 2,9 | 1.581 | -1,9 | 71.764 | -31,9 | -3.353 | -128,4 |

| | | | | | | | | |

| Food and beverage services | 12.155 | -1,7 | 54.256 | -4,6 | 2.103.554 | -45,1 | 4.368 | -96,3 |

| Restaurants | 3.960 | 0,5 | 24.654 | -4,3 | 1.082.420 | -43,9 | -45.672 | -230,0 |

| Other meal services | 274 | 0,4 | 10.012 | -6,3 | 282.882 | -31,2 | -9.507 | -160,7 |

| Drinking establishments | 7.921 | -2,8 | 19.590 | -4,0 | 738.252 | -50,5 | 59.547 | -11,4 |

Date June 8, 2022

Source: Eustat. Services survey

The final result for Accommodation services for the financial year was negative in the amount of 78.6 million euros, compared to the surplus of over 62 million for the 2019 financial year, due to the sharp drop in sales in 2020 and fact that the other items of income and expense also fell to a similar extent.

This Accommodation services division comprises the Hotels and Other accommodation sub-sectors, with the former playing a more decisive role: 74.8% of employment and 73.2% of turnover in 2020.

As occurred with the other groups, in this case they both also presented negative relative figures for the performance of employment and turnover compared to 2019. However, while in Other accommodation the adjustment in employment was -1.9% and the fall in sales was limited to -31.9%, in the case of Hotels, employment dropped by 16.7% and turnover fell by 65.9%, that is, Hotels turned over one third of the amount achieved in 2019.

It is worth highlighting that in the case of both Food & Drink and Accommodation services, the least affected sales were those of less traditional sectors, such as the aforementioned Other accommodation (campsites, apartments, etc.) and Other food services (catering). Indeed, while sales fell by 65.9% for Hotels, -43.9% for Restaurants and -50.5% for Drinks establishments, for Other accommodation and Other food services they dropped by approximately 30% in both cases.

The greatest impact was felt in the provinces of Álava, in employment and sales, and Gipuzkoa, in results for the financial year.

As regards provinces, all three registered a negative performance in turnover and employment in 2020. Hospitality in Álava was the most affected, with a reduction of 6.8% in employment and 49.4% in sales. In Gipuzkoa, sales shrank by 48.8% and employment fell by 5%. In Bizkaia, employment decreased at a similar rate, -5.6%, but the drop in turnover was less marked at -45.8%.

The final result for the financial year is a deficit for the three provinces, with amounts ranging from almost three million euros in Álava and over 39 million in Gipuzkoa.

Main variables of Hospitality sector of the Basque Country by province (thousands of euros). 2020

| | Basque Country | Increase (%) 2010-2019 | Araba/Álava | Increase (%) 2010-2019 | Bizkaia | Increase (%) 2010-2019 | Gipuzkoa | Increase (%) 2010-2019 |

| NU establishments | 13.523 | -1,4 | 1.961 | -1,3 | 7.144 | -1,4 | 4.418 | -1,4 |

| Personnel employed NU | 60.519 | -5,6 | 8.650 | -6,8 | 30.214 | -5,6 | 21.655 | -5,0 |

| Turnover | 2.370.900 | -47,4 | 338.476 | -49,4 | 1.168.716 | -45,8 | 863.708 | -48,8 |

| Profit for the year | -74.255 | -141,2 | -2.888 | -114,1 | -31.729 | -139,8 | -39.638 | -149,5 |

Date June 8, 2022

Source: Eustat. Services survey

Bizkaia accounted for half of the hospitality industry in the Autonomous Community; specifically, 52.8% of establishments and 49.9% of employment. Hospitality in Gipuzkoa represented 32.7% of establishments and, slightly higher, 35.8% of employment, meaning that the contribution made by Álava was limited to 14.3% of employment and 14.5% of places of business.

However, there were significant comparative differences in the distribution of the various activities within each of the provinces. As such, in Gipuzkoa, there was a notably larger proportion of Restaurants, which accounted for 35.9% of all establishments in the province and 45.5% of jobs there, compared to 28.7% of establishments and 40.6% of jobs in hospitality in Álava, and 25.3% of establishments and 37.4% of jobs in Bizkaia, all as a proportion of hospitality as a whole in their respective territories.

Another sub-sector that varied across the provinces was Hotels. 7.2% of all hospitality establishments in Gipuzkoa were hotels, whereas in the other two provinces this proportion dropped to 3.4% in Bizkaia and 3.6% in Álava. In terms of employment, it accounted for 9.9% of all jobs in this sector in Gipuzkoa, 6.5% in Bizkaia and 6.4% in Álava.

Overall, the sub-sector of Drinks Establishments was the largest in terms of the number of establishments, but to widely varying degrees: 65.8% in Bizkaia, 58.1% in Álava and 47.1% in Gipuzkoa. In Bizkaia, 53.4% of employment in hospitality corresponds to drinks establishments, but in Álava the figure drops to almost 35% and in the case of Gipuzkoa, it is just 28%.

Although the provincial variations in performance in the various sub-sectors are similar to one another, Drinks establishments is, in point of fact, the one that registers the greatest differences in performance. As such, in Bizkaia turnover fell by 48.5% in this type of establishment, it dropped by 51.7% in Gipuzkoa and by as much as 56.2% in the case of Álava.

As regards restaurants, the second biggest sub-sector in terms of volume, turnover shrank by 45% and 45.6% in Álava and Gipuzkoa, respectively; in Bizkaia it fell by 41.9%.

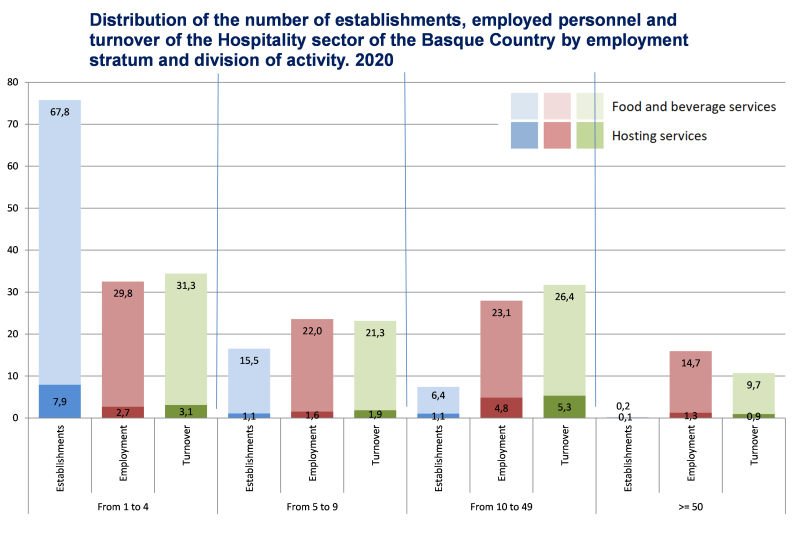

Micro-enterprises (employing one to nine people) were more resilient to the effects of the pandemic

In the context of a general downturn in economic indicators, the most recent performance reveals that, in relative terms, micro-enterprises (employing one to nine people) registered less negative performance in employment and in the number of establishments compared to small companies (employing 10 to 49 people) or medium and large enterprises (employing over 50 people).

Within micro-enterprises, the stratum of 1 to 4 people lost just 57 establishments and 275 jobs, representing a drop of 0.6% and 1.4%, respectively. The next stratum in micro-enterprises, 5 to 9 jobs, registered similar figures: a 1% drop in establishments and 0.8% fewer jobs. Lastly, with larger losses, albeit smaller than those registered by the biggest group, the stratum of 10 to 49 employees recorded a drop in employment of 7.2%, with establishments down 8.1%.

By contrast, the largest-sized group, medium and large enterprises, presented more negative performance indicators, with a reduction in number from 53 in 2019 to 34 last year, that is, almost 36% fewer and, in parallel, they lost 16.2% of their employees between these two dates.

Although the drop in turnover was shared by all the strata at similar levels, within micro-enterprises the stratum of 1 to 4 jobs again presented the least negative results, -44.6 %, compared to -54.8% for the highest stratum.

An analysis of the size of establishments in the Hospitality sector revealed a high concentration of micro-enterprises (with fewer than 10 employees) within the sector. In 2020, they accounted for 92.3% of all establishments and generated 57.6% of total turnover, with 56.1% of jobs.

By contrast, companies with 50 or more employees (medium and large enterprises), which represent only 0.3% of the total number of establishments, were responsible for 10.7% of the total turnover and provided work for 15.9% of the persons employed in the Basque hospitality sector.

For further information:

Eustat - Euskal Estatistika Erakundea / Basque Statistics Institute

C/ Donostia-San Sebastián, 1 01010 Vitoria-Gasteiz

Press Service: servicioprensa@eustat.eus Tel.: 945 01 75 62