Press Release 13/06/2022

Machine tool sector. 2022

The Machine tool sector in the Basque Country recovered in 2021 with an increase in activity of around 20%

Machine tools exports were worth 654.8 million in 2021 and our main client was the United States, followed by Germany

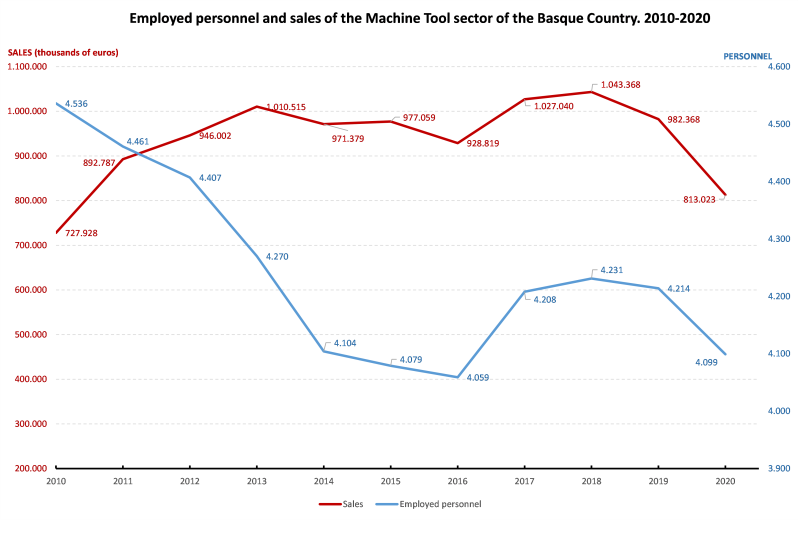

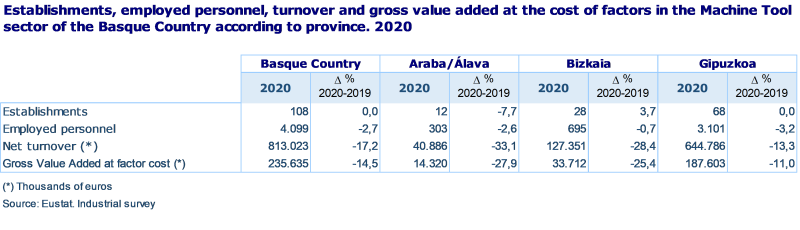

Between 13 and 17 June 2022, the 31st edition of the Machine Tool Biennial will take place at the Bilbao Exhibition Centre in Barakaldo. This gathering sheds light on the importance that machine tools have as an economic sector for the Basque economy, which, following a year of intense activity, recorded estimated growth of around 20% in 2021, according to Eustat data. In 2020, a year marked by COVID-19, the sector had a turnover of €813 million, after achieving turnover figures of more than €1,000 million two years earlier, and provided employment for 4,099 people. Basque Machine Tools accounted for 53% of the Machine Tool sector for Spain as a whole in 2020.

This is a strategic sector because Machine tools play a role in a large part of the manufacturing industry, by providing it with the necessary productive means to carry out its production activities. It encompasses, among others, the manufacture of metal forming machinery, machines for turning, milling, shaping, planing, the manufacture of punch presses, hydraulic presses, hydraulic brakes, forging machines, draw benches, thread rolling machines, roll-forming machines, sheet metal cutting machines, etc.

In 2020, when the most severe restrictions were imposed on the activity due to the COVID-19 pandemic, the turnover of the 108 machine tool establishments fell by 17.2%, in line with the results for industry as a whole in the Basque Country, which underwent an adjustment of 18.2%.

In absolute terms, the final turnover figure for the sector was €813 million in 2020, compared to €982.4 million the previous year. In addition, the sector had just experienced two years, 2017 and 2018, when record figures were achieved, with revenues over one billion: 1,043.4 million in 2018 and 1,027 million in 2017.

In addition, the Machine tool sector was able to maintain employment in 2020, with the loss of just over 100 jobs compared to 2019, representing a 2.7% drop, slightly less than the overall figure for industry (-3.0%)

Employment in the sector remained relatively stable throughout the decade, above four thousand employees at all times, ranging from the minimum of 4,059 registered in 2016 to 4,536 in 2010; the 4,099 persons employed in 2020 represent slightly more than 2% of the total number employed in industry.

In this regard, the sector presented a significantly larger concentration of employment than industry as a whole; as such, while the average size for all industrial establishments was 18 people, the figure was twice as high for machine tools, with 38 persons employed.

An analysis by province reveals the undeniable dominance of Gipuzkoa. More than six out of ten establishments in the autonomous region are located in this province, which concentrated 75.7% of personnel in the sector and as much as almost 80% of turnover in 2020, a situation that has barely changed over recent years. For their part, Bizkaia (28 establishments) and Álava (12 establishments) divided up the rest of the jobs, with 17% for the former and 7.4% for the latter, and turnover, with 15.7% and 5%, respectively.

The prominent position occupied by Gipuzkoa is particularly notable in productivity per person. This is an indicator of efficiency and a key measure of economic performance as it links employment to the added value generated in the production process. In Gipuzkoa this indicator was significantly higher throughout the decade, with figures over €70,000 per person from 2015 onwards, compared to Álava and Bizkaia which registered around €65,000 per year.

Moreover, while the average productivity fell by 25% in these two provinces in the year of the pandemic, 2020, Gipuzkoa was able to remain above €60,000, with an adjustment of only 8%.

Machine tools, a sector open to international trade: 654.6 million exported in 2021

One sign of the high level of commercial integration of the Basque Machine tool sector of industry in international markets is what is known as export propensity, defined as the quotient of sales made in foreign markets and the gross value added at factor cost for each company.

This indicator was 275.9% in 2020 according to the Industrial Survey, in sixth position among the 42 industrial sectors, behind only Building of ships and boats, Manufacture of motor vehicles, trailers and semi-trailers, Iron and steel products, Manufacture of other transport equipment, except Building of ships and boats and Manufacture of basic precious and other non-ferrous metals, in order of importance, with export propensity ranging from 291.2% for the last-named to 1,483% for Building of ships and boats.

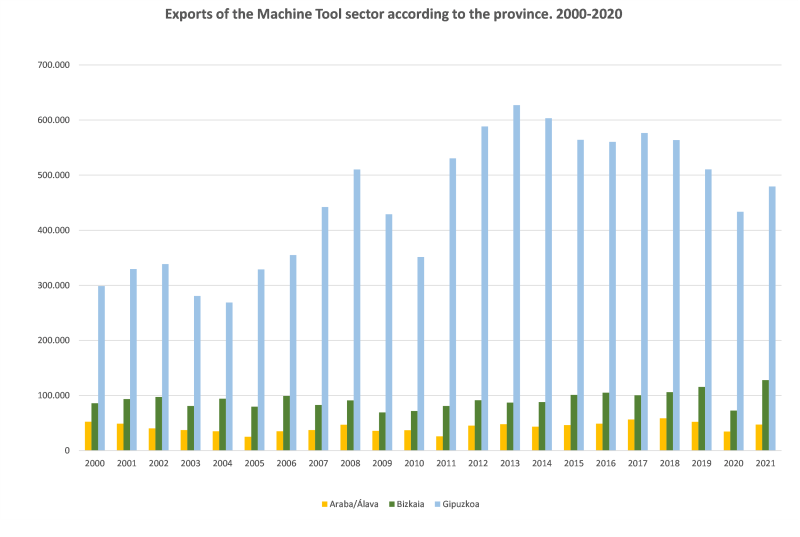

In 2021 exports of products relating to the activity of the machine tool sector amounted to €654.8 million, having topped 700 million per year between 2012 and 2018 and attained the largest value in the historical series in 2013, when the figure of 762.3 million was registered. Products worth €140.4 million were exported during the first quarter of 2022.

Exports of machine tools in 2021 represented 2.6% of the total value exported by our autonomous region, which stood at 25,665.4 million.

The bulk of the sector's exports came from establishments in Gipuzkoa, 73.2% in 2021, while Bizkaia accounted for 19.6% and Álava the remaining 7.2%. This distribution is weighted even more heavily towards Gipuzkoa than in previous years, with eight of every ten euros exported coming from this province.

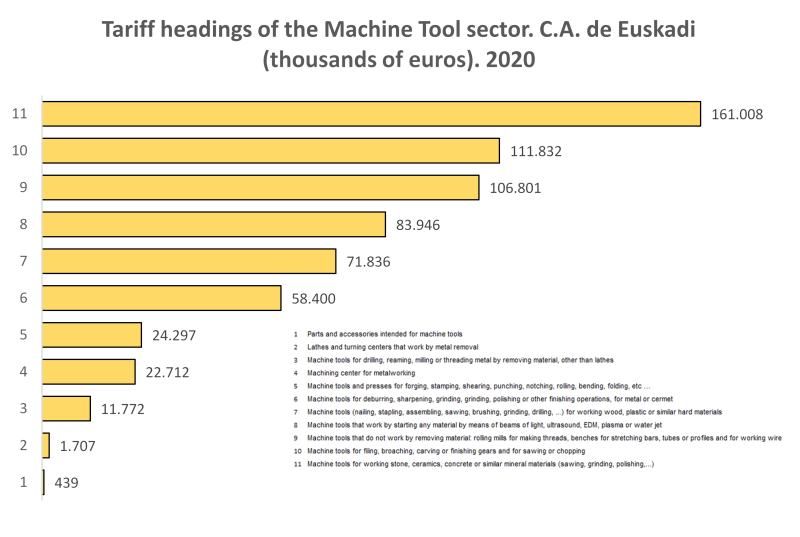

Three products or customs duty groups stand out above the rest. These are Parts and accessories for machine tools, Lathes and turning centres for removing metal and Machine tools for drilling, boring, milling or threading metal other than lathes. Between the three of them, they account for a total of 379.6 million, 58% of the 654.8 million exported in 2021. In the first case, exports amounted to 161 million euros, in the second, 111.8 million, and in the third, 106.8 million.

The Parts and accessories for machine tools group has historically been the top exporter; it has not been bettered by another group since 2014, until which year Machine tools and presses for forging, die-stamping, shearing, punching, notching, rolling, bending, folding, etc. held first place in the machine tool sector.

It transpires that exports for Lathes and turning centres for removing metal in Bizkaia (69.1 million) were higher than in Gipuzkoa (42.7 million) a province that is otherwise predominant in the rest of the major groups.

Other smaller groups are Machining centres for working metal, Machine tools and presses for forging, die-stamping, shearing, punching, notching, rolling, bending, folding, etc., Machines for deburring, sharpening, grinding, rectifying, polishing or other finishing operations, for metal or cermet, with between 84 and 58 million euros.

As regards foreign markets, there are seven main countries that receive exports from the machine tool sector, corresponding to a wide range of geographical areas. Top of the list is the United States, where products worth 87.9 million were exported in 2021, 13.4% of the total, followed by Germany with 81 million and 12.4%, Italy, 69.1 and 10.6 %, the People's Republic of China, 54 million and 8.3%, France, 39.5 million and 6%, Turkey, 38.4 million and 5.9%, and India with 34.6 million and 5.3% of the total. Together, these seven countries receive 61.8% of our machine tool exports.

In point of fact, this diversity of destination areas, in short, the global nature of machine tool exports, is what distinguishes the sector from the rest of industry. Indeed, 63.5% of industry exports overall went to EU27 countries in 2021, practically the same percentage that the machine tool sector sent to the top seven countries, which, however, correspond to three different geographical areas.

Imports of Machine tool industry products worth 144.8 million were also registered, meaning that the sector had a positive trade balance, 510 million euros, in 2021.

The order of importance for the imported groups was almost the same as for exports. The same group was top, Parts and accessories for machine tools (77.2 million), but Machining centres for working metal moved up into second place with 26.4 million, and Lathes and turning centres for removing metal was third (10.7 million), with all three together accounting for 79% of imports.

Gipuzkoa, once again, was the province that imported the most in this sector, but to a lesser degree than in exports; it received 57.5% of imports in 2021, while Bizkaia imported 22.9% and Álava acquired 19.6% of the total value.

R&D and Innovation - key elements in the machine tool sector

On another front, it is widely recognised that exports are driven by technological and organisational factors. The Innovation Survey prepared annually by Eustat is designed to measure the effort made by the various sectors of the economy in innovation. The latest data available correspond to 2020.

The Machine tool sector belongs to the Machinery & equipment division, which, along with the activities corresponding to the former, includes those relating to the Manufacture of general use machinery, Manufacture of agricultural and forestry machinery and Manufacture of other machinery. According to the aforementioned survey, in this division, the maximum level of disaggregation at which data can be obtained, 57.7% of establishments with ten or more persons employed (the only employment stratum taken into consideration at European level) conducted innovation of some type in the three-year period 2018-2020. This same figure stood at just 31.4% for the sectors as a whole.

If only product innovation is considered, the proportion of innovators in the Machinery & Equipment division is 48.0% compared to 20.9% for all the sectors and, in the case of process innovation, it is 47.0% for the division that includes the Machine tool sector and 27.9% for the sectors as a whole. As such, it can be easily extrapolated that the Machine tool sector is highly innovative.

This idea of a technologically qualified sector is supported by the fact that, according to the Innovation and Technological Development survey published annually by Eustat, 35 establishments conducted R&D projects at their own initiative in 2020, in the order of 23 million; that is, 2.3% of all the establishments in the Basque Country that conducted R&D and 1.5% of total intra-mural expenditure.

One final figure: according to the latest Eustat Information Society Survey, 33.5% of Basque establishments with ten or more jobs conducted e-commerce in 2021 (either purchases or sales). This number was far outstripped by the Machinery & equipment division (again, the maximum level of disaggregation for these data), which reached 47.9%. It is worth highlighting the importance of e-commerce in driving commercial transactions both nationally and internationally, expanding potential markets.

For further information:

Eustat - Euskal Estatistika Erakundea / Basque Statistics Institute

C/ Donostia-San Sebastián, 1 01010 Vitoria-Gasteiz

Press Service: servicioprensa@eustat.eus Tel.: 945 01 75 62