Press Release 09/03/2022

ENVIRONMENTAL ACCOUNTS. ENVIRONMENTAL TAXES ACCOUNT. ADVANCE. 2020

Environmental taxes in the Basque Country stood at 1,177 million euros in 2020, down 14.1% on the previous year

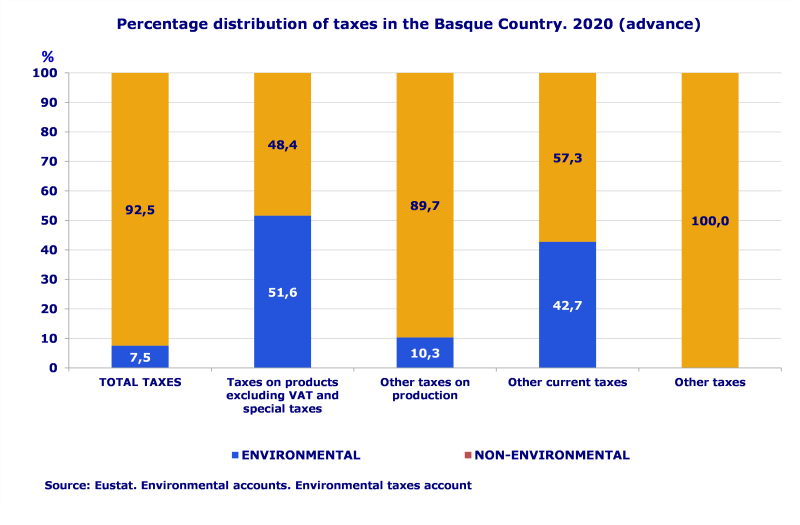

Environmental taxes in 2020 accounted for 7.5% of all taxes in the Basque Country, 5 tenths less than in 2019

In 2020, environmental taxes in the Basque Country stood at 1,177 million euros, down 193 million on the previous year (-14.1%), according to the Environmental taxes account prepared by Eustat.

This account is part of the system of environmental accounts and is prepared according to Eurostat's methodology. Its framework comprises all taxes whose tax base is a physical unit (or a proxy of it) of something that has a proven, specific negative impact on the environment and which is defined in the European System of Accounts (SEC2010) as a tax.

Based on criteria of an environmental nature, environmental taxes are grouped into three categories: Energy taxes, Transport taxes and Taxes on pollution and resources.

Environmental Taxes in the Basque Country by environmental nature (thousand euros). 2016-2020

| | 2016 | 2017 | 2018 | 2019 | 2020(a) | Annual variation rate (%) |

| | | | | | | 2019/2018 | 2020(a) /2019 |

| TOTAL ENVIRONMENTAL TAXES | 1.145.635 | 1.201.973 | 1.256.231 | 1.370.226 | 1.177.409 | 9,1 | -14,1 |

| Taxes on energy | 987.302 | 1.034.555 | 1.081.959 | 1.194.254 | 1.011.490 | 10,4 | -15,3 |

| Taxes on transport | 148.787 | 156.948 | 163.503 | 164.903 | 154.244 | 0,9 | -6,5 |

| Taxes on contamination and resources | 9.545 | 10.470 | 10.769 | 11.070 | 11.675 | 2,8 | 5,5 |

(a)Summary

Date March 9, 2022

Source:Eustat. Environmental accounts. Environmental taxes account

Of particular note was the decline in income generated by Energy taxes, as a result of the evolution of the special hydrocarbon tax

As regards the types of environmental taxes, energy taxes registered the highest amount, reaching 1,011 million in 2020, accounting for 85.9% of total environmental taxes, but they also experienced the biggest decrease compared to 2019, down 15.3%. This drop was a direct consequence of the evolution of the special hydrocarbon tax, which, with 826 million, represented 81.6% of energy taxes and posted a decrease of 19.6%, i.e. 201 million less than in 2019. The economic and health situation stemming from COVID 19 led to lower consumption of products subject to tax and, consequently, a reduction in tax revenue. It was followed in this group by tax on the value of electricity production and greenhouse gas emission rights, which together increased by 31.3% in respect of the previous period, i.e. 23 million.

In second place were transport taxes, which contributed 13.1% of total taxes of an environmental nature, reaching 154 million euros in 2020, down 6.5% on the previous year. The main tax in this category is the tax on mechanical traction vehicles, which, with 138 million euros in 2020, accounted for 89.4% of this group of taxes.

Lastly, taxes on pollution and resources represented 1.0% of total taxes of an environmental nature, and rose by 5.5% in 2020 compared to the previous year, standing at 12 million euros. The increase in fees was at the root of this rise.

Income generated by environmental taxes accounted for 7.5% of all taxes in the Basque Country

With regard to total taxes in the Basque Country, in 2020 environmental taxes represented 7.5%, 5 tenths less than in 2019 (8.0%).

As regards classification by type of tax, most taxes of an environmental nature were concentrated in Taxes on products, excluding VAT and Taxes on imports; in 2020, 51.6% of taxes recorded in this type corresponded to environmental taxes, amounting to 968 million euros. It is worth noting that in 2020 they registered a drop of 17.8%.

Within Other current taxes, environmental taxes accounted for 42.7%, reaching 138 million euros, with a slight rise compared to 2019 (+0.6%). Finally, within Other taxes on production, 10.3% corresponded to environmental taxes, i.e. 71 million euros, representing an increase of 27.6% in relation to 2019.

European comparative analysis of the environmental tax burden

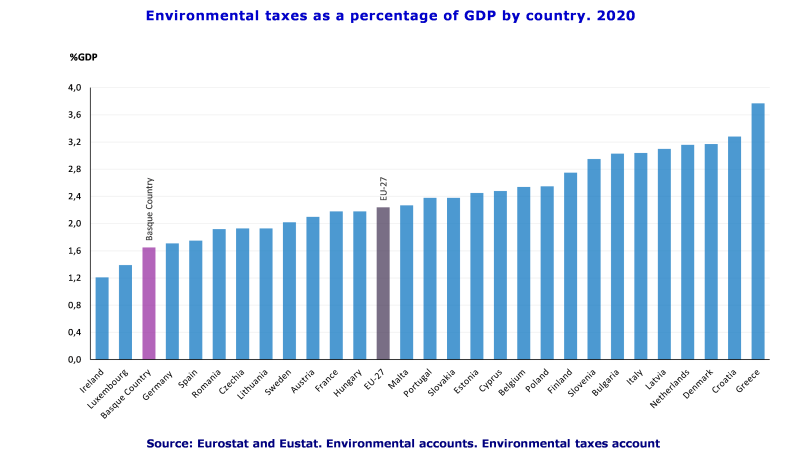

Green taxation, measured as a percentage of environmental tax revenue over GDP, stood at 1.65% in the Basque Country in 2020, below almost all European countries, from Germany (1.71%) to Spain (1.75%), France (2.18%) and Sweden (2.02%), among others. The average for the EU27 was 2.24%. On the other hand, the rate in the Basque Country was higher than in Ireland (1.21%) and Luxembourg (1.39%). At the very top of the table were countries such as Greece, Croatia and Denmark, with rates above 3%.

Provincial analysis of Environmental Taxes

The distribution of environmental taxes by province for 2020 revealed that Bizkaia accumulated 53.4% of the total, Gipuzkoa 32.1% and Álava accounted for the remaining 14.5%.

Furthermore, although the aforementioned fall in taxes was 14.1%, of particular note was the drop in Álava (-17.6%), followed by Gipuzkoa (-16.1%) and, lastly, Bizkaia with -11.8%.

Environmental Taxes in the Basque Country by province (thousand euros). 2017-2020

| | 2017 | 2018 | 2019 | 2020(a) | Annual variation rate (%) |

| | | | | | 2018/2017 | 2019/2018 | 2020(a) /2019 |

| BASQUE COUNTRY | 1.201.973 | 1.256.231 | 1.370.226 | 1.177.409 | 4,5 | 9,1 | -14,1 |

| ARABA/ALAVA | 188.774 | 193.726 | 207.754 | 171.184 | 2,6 | 7,2 | -17,6 |

| BIZKAIA | 617.942 | 662.638 | 712.009 | 628.181 | 7,2 | 7,5 | -11,8 |

| GIPUZKOA | 395.257 | 399.867 | 450.463 | 378.044 | 1,2 | 12,7 | -16,1 |

(a)Summary

Date March 9, 2022

Source:Eustat. Environmental accounts. Environmental taxes account

For further information:

Eustat - Euskal Estatistika Erakundea / Basque Statistics Institute

C/ Donostia-San Sebastián, 1 01010 Vitoria-Gasteiz

Press Service: servicioprensa@eustat.eus Tel.: 945 01 75 62