Press Release 29/10/2021

EQUITY ACCOUNTS OF NON-FINANCIAL COMPANIES. 2019

The total debt of non-financial companies in the Basque Country stood at 46.1% in 2019, the lowest level of the decade

Economic and financial profitability increased, standing at 5% and 8.1%, respectively

The Total Debt ratio of non-financial companies in the Basque Country stood at 46.1% in 2019, according to Eustat data. This indicates that at least half of the assets of the non-financial companies in the Basque Country were financed with external resources and was 1.5 percentage points down on 2018. In fact, since 2009, when Statistics on the Equity Accounts of Non-Financial Companies were introduced, this figure has steadily fallen from around 60% in 2009, achieving over these ten years a reduction well in excess of ten points. This indicator links external funds to total resources and enables the financial risk of a company to be measured.

In 2019, the total debt ratio was higher for large corporations (48.7%), than medium-sized enterprises (48.4%) and microenterprises (41.9%).

However, there are some more significant differences according to the activity sector of the company: The highest total debt ratios, all over 60%, were, in this order, Transport Material (68.8%), Other Services (63.9%), Hospitality (62.7%) and Telecommunications (60.9%). At the other extreme, were the sectors of Pharmaceutical Products, Water Supply & Sanitation and Property Activities, all with ratios below 30%.

From a more immediate perspective over time, the Debt Quality Ratio correlates a company’s short-term and long-terms debts. In theory, the further away the maturities - and the ratio is as small as possible - the better the debt quality. In 2019 the debt quality ratio in the Basque Country was 61.1%, 1.3 points higher than in 2018, with no significant differences between different sized companies. Once again, the type of activity denotes considerable differences: while in up to eleven sectors the ratio exceeded 70%, the most notable among them being Publishing, imaging, radio and television (76.3%) and Computing (75.4%), in others, such as Telecommunications and Property activities it barely surpassed 30%.

Lastly, the Consistency Ratio, a reflection of the guarantee offered by companies to long-term creditors, stood at 328% in 2019, which meant an improvement of twenty points in relation to 2018, and ranged from 166.8% in the Textile, Garments, Leather & Footwear sector to 727.3% in the Other Professional Activities sector.

With respect to the economic analysis of non-financial companies, the Economic Profitability ratio provides information on a company’s average return on its total assets, and hence the efficiency of the company’s management. High values means that less assets are required to achieve higher profits.

For an average economic profitability of 5%, the size of the company introduces some variations. Thus, small enterprises (with 10 to 49 employees) have the most favourable economic profitability ratio, 5.6%, as they have had since 2014, despite this indicator experiencing a drop of two tenths of a point in respect of the previous year, 2018. In turn, companies with 50 or more employees advanced six tenths of a point and achieved an economic profitability of 5.4% in 2019. Finally, for microenterprises (with 1 to 9 employees), with year-on-year growth of two tenths of a point, this indicator stood at 4.3%.

Of particular note in 2019 is the economic profitability of the Chemical Industry, 12.9%, as well as that related to Pharmaceutical Products and Rubber and Plastics, 8.8% and 8%, respectively.

Financial Profitability, on the other hand, expresses the profit obtained by the company from its activities based on net equity. In other words, it is the company’s capacity to pay its owners or shareholders. As with economic profitability, the positive trend seen in previous years continued in 2019, with the ratio reaching 8.1%, four tenths of a point more than in 2018, by far the highest value of the available series.

Medium-sized enterprises again recorded the best figures, with an average financial profitability of 9.4%, closely followed by 9.2% for large corporations and 6.3% corresponding to microenterprises.

For this indicator, up to nine sectors obtained profitability higher than 10%, led by the sectors of Chemical Industry and Rubber and Plastics, which also headed economic profitability, the ranking of financial profitability, with 20% and 16.3%, respectively. The Transport Material sector, whose financial profitability was 16.2%, should also be included with the above.

Another measure of interest in terms of the economic progress of companies is the Current Asset Turnover ratio. It shows the number of times current assets have been used to generate sales, thereby quantifying the use of available resources. A high ratio denotes a good use of available resources.

In 2019, the ratio was 1.8 times for non-financial companies in the Basque Country, the same as that registered in 2018. In other words, current assets were turned over 1.8 times in a year and hence current assets were capable of generating almost two sales in a year.

Some sectors greatly exceeded the general average. This was the case in the Hospitality sector, which, with a turnover ratio of 3.6, doubled the average turnover; and the Electricity, Gas & Steam sector, which, with a ratio of 3, easily exceeded it.. At the other extreme, with asset turnover ratios below 1, were the sectors of Property Activities, 0.4; Consultancy and Other Professional & Technical Activities sector, 0.8; and Construction, all these sectors need more than a year to realise the sale of their current assets.

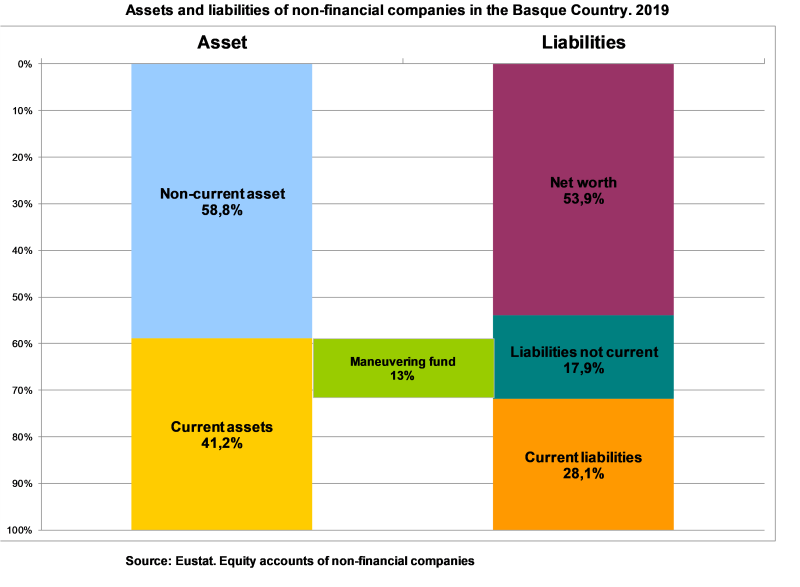

The analysis of the structure of assets and liabilities in the 2019 tax year provides more detailed information on non-financial companies. In 2019, fixed or non-current assets - resources that benefit the company in the long-term - represented 58.8% of total assets whereas asset turnover provided the remaining 41.2%, following the former decreasing by one tenth of a point and the latter increasing by it in respect of 2018.

In turn, within liabilities and net equity as a whole, the share of own resources or net equity was 53.9% in 2019, up 1.5 percentage points with respect to 2018, while within short-term debts as a whole, current liabilities stood at 28.2%, registering no significant variation, down three tenths of a point. Long-term debts or non-current liabilities saw a drop of 1.2 percentage points, standing at 17.9%.

From a broader perspective over time, net equity – principally shareholder contributions, reserves and profits – has been progressively increasing since 2010, when it was 43.5%, to the detriment of current liabilities, with 30.6% in that year, and, to a greater extent, non-current liabilities – 25.8% in 2010.

With these results, Working Capital, the company’s capacity to meet its short-term debts, which is calculated as the difference between current assets and current liabilities, was positive and valued at 27,201 million euros (13% of total assets), four tenths of a point higher than in 2018. This means that sufficient resources have been generated to cover specific short-term debts, and to a greater degree than in the previous year.

For further information:

Eustat - Euskal Estatistika Erakundea / Basque Statistics Institute

C/ Donostia-San Sebastián, 1 01010 Vitoria-Gasteiz

Press Service: servicioprensa@eustat.eus Tel.: 945 01 75 62