Press Release 09/07/2021

BASQUE INDUSTRY OVERVIEW. 2021

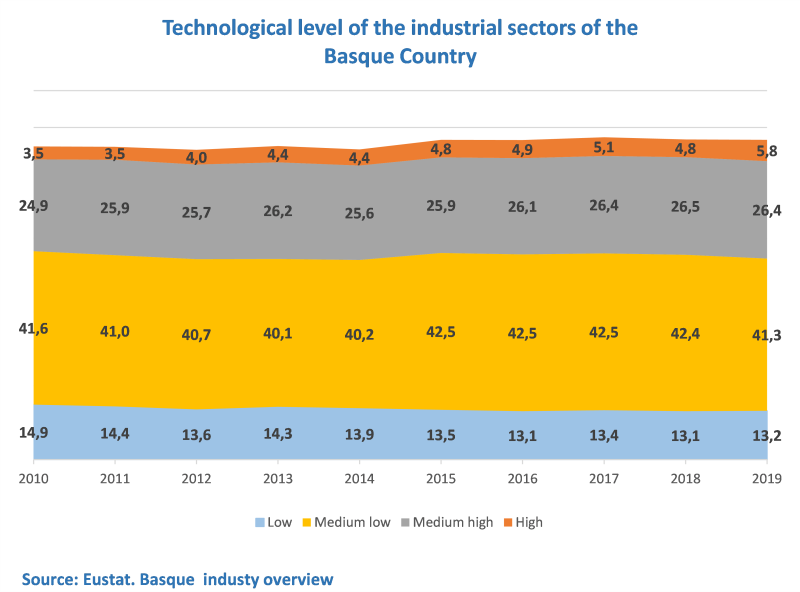

32% of industrial GVA was generated by the high and medium-high technology sectors in 2019

Expenditure by industry as a whole on innovation activities for 2019 accounted for 35.8% of total spending

Activities regarded as high or medium-high technology generated 32.2% of the Gross Value Added of Basque Industry in 2019. After growing by almost four percentage points (3.8), this proportion was the highest in the last ten years, according to the Basque Industry Overview prepared by Eustat.

Furthermore, the relative weight of industry in the Basque economy was 23.9% in 2019 and, despite the fact that its share fell by just over one percentage point compared to 2010, it was still clearly higher than the proportion in Spain (16.1%), France (13.5%) or the European Union 28 (18.8%), and only slightly below that of Germany (24.3%).

Regarding the percentage distribution of value added of industry among the different branches of industrial activity, a significant percentage weight was observed in traditional sectors such as Metallurgy & Metal Products, the largest with 27.4% of the GVA of Basque Industry, or Transport Material with an 11.9% share.

In this vein, one of the most starkest characteristics of Basque industry was its high sectoral concentration, which has varied little in recent years. If Electricity, Gas & Steam and Machinery and Equipment were added to the sectors mentioned above, they would make up 60.1% of industrial value added in 2019, 3.2 points more than in 2010, following small fluctuations between both years.

The average size of establishments in Basque industry was 16.4 employees, with large variations between different sectors. The large majority of industrial establishments, namely 83.9%, had at least 20 workers and accounted for 21.3% of jobs. At the other extreme, 0.7% of establishments with more than 250 workers accounted for 25.8% of jobs.

In analysing competitiveness, the unit labour cost is a basic variable that allows the impact of the cost of labour per product unit to be analysed: that is, to measure the joint effect of the cost of labour and productivity variables. A comparative analysis with other economies reveals that the Basque manufacturing industry has a more competitive position than the Spanish economy and the European Union average, both in 2009, with lower unit labour costs, and in 2018, the most recent comparable data, even with higher unit labour costs. It was also more productive, which gave rise to a relative increase in competitiveness. To put it another way, in 2009, spending on salaries in the Basque Country generated 38% more value added, rising to 49.8% in 2018 after the downturns observed between 2012 and 2014.

Another distinguishing feature of Basque industrial companies is that they were clearly outward-oriented, as reflected by their high propensity towards exports (proportion of industrial exports over industrial GDP). This indicator reached a value of 156% in 2019, with the sectors of Coke Plants & Oil Refining (481%), Transport Material (404%) and, trailing at a distance, Machinery and Equipment (191%) and Electrical Material & Equipment (158%).

Continuing under the heading of external trade, year-on-year variation rate of industrial imports and exports were negative in 2019, with a 1.2% decrease in exports and a 1.6% drop in imports after two years of positive values in 2017 and 2018. The fact that the decrease in imports was higher than in exports gave a trade balance of industrial goods (the difference between the value of exports and imports) of 5,327 million euros, 24 million more than in 2018.

Finally, the Basque Industry Overview 2019 also analyses innovation and the use of information and communication technologies, as undisputed driving forces for improving competitiveness. Expenditure by industry as a whole on innovation activities for 2019 accounted for 35.8% of total spending in the Basque Country. Transport Material was the largest sector, which accounted for almost one in three euros (30.9%) spent on innovation in industry.

The most marked element in the weight of each type of activity in the Basque Country was internal R&D, representing almost half, 45.5%, of total expenditure by industry, followed by capital expenditure, 27.1%, and resources allocated to external R&D, which with 19.4% occupied third place.

Basque industry has a high level of implementation of Information and Communication Technologies. 96.8% of industrial establishments had a computer, 95.5% had e-mail, 95.6% had internet, 65.9% had a website and 94.9% had a mobile phone.

E-commerce is one of the many possibilities that the Internet offers. This last year, there has been a rise in both turnover and in the number of participating companies, where 34.1% of industrial establishments with more than 10 employees made purchases or sales over the Internet in 2019, compared to 33.8% in 2018.

Methodological note:

The structure of this Industry Overview consists of 10 chapters. The first three are devoted to situating industry in the local and international macroeconomic context; industrial production is analysed and an overview is given of the competitiveness indicators that are essential to the classical study of economic sectors. The following chapters analyse the orientation of the Basque industrial market from a foreign trade perspective, looking at the trends and characteristics of employed personnel, as well as analysing investment. Certain key aspects in current economic development are also studied: the progression of innovation in the industrial sector and the implementation of "Information and Communication Technologies" (ICT) in industrial companies in the Basque Country. It ends with a look at entrepreneurial dynamism and analyses industry from a closer geographical perspective, the regional level.

For further information:

Eustat - Euskal Estatistika Erakundea / Basque Statistics Institute

C/ Donostia-San Sebastián, 1 01010 Vitoria-Gasteiz

Press Service: servicioprensa@eustat.es Tel: 945 01 75 62