Press Release 11/03/2021

ENVIRONMENTAL ACCOUNTS. ENVIRONMENTAL TAXES ACCOUNT. 2019

Environmental taxes in the Basque Country rose by 11.3% in 2019

Environmental taxes in 2019 accounted for 8.2% of all taxes in the Basque Country, 0.6 percentage points more than in 2018.

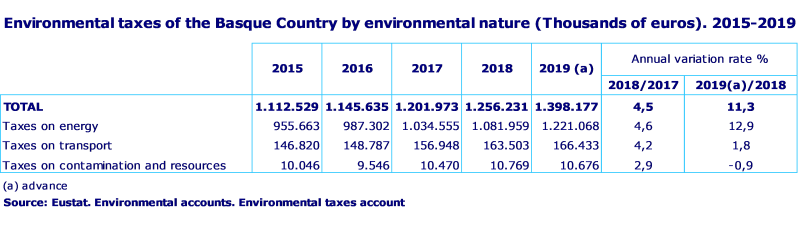

In 2019, environmental taxes in the Basque Country stood at 1,398 million euros, 142 million more than the previous year (11.3%), which corresponded to 1.8% of GDP, according to the Environmental taxes account prepared by Eustat.

Environmental taxes are defined by Eurostat as those whose tax base is a physical unit (or a proxy of it) of something that has a proven, specific negative impact on the environment and which is defined in the European System of Accounts (SEC2010) as a tax.

Environmental taxes are grouped into three categories: Energy taxes, Transport taxes, Pollution taxes and Resource taxes.

Energy taxes registered the highest amount, reaching 1,221 million in 2019, 87.3% of the total. Within this group, the most significant was the special hydrocarbon tax which, with 1,054 million, accounted for 86.3% and was up 14.4% in respect of 2018. This increase is due to the legislative change that integrated the autonomous regional rate into the special national tax rate, in order to guarantee market unity in the area of fuel. As a consequence, energy taxes as a whole increased by 12.9% compared to 2018.

In second place, were transport taxes which represented 11.9% of the total, reaching 166 million euros in 2019, up 1.8% on the previous year. The main tax is this category is the tax on mechanical traction vehicles, which with 139 million euros in 2019 accounted for 83.2% of this group of taxes.

Finally, taxes on pollution and resources represented the remaining 0.8% and had a greater year-on-year variability; in 2019 they fell by 0.9% compared to the previous year, remaining at 11 million euros.

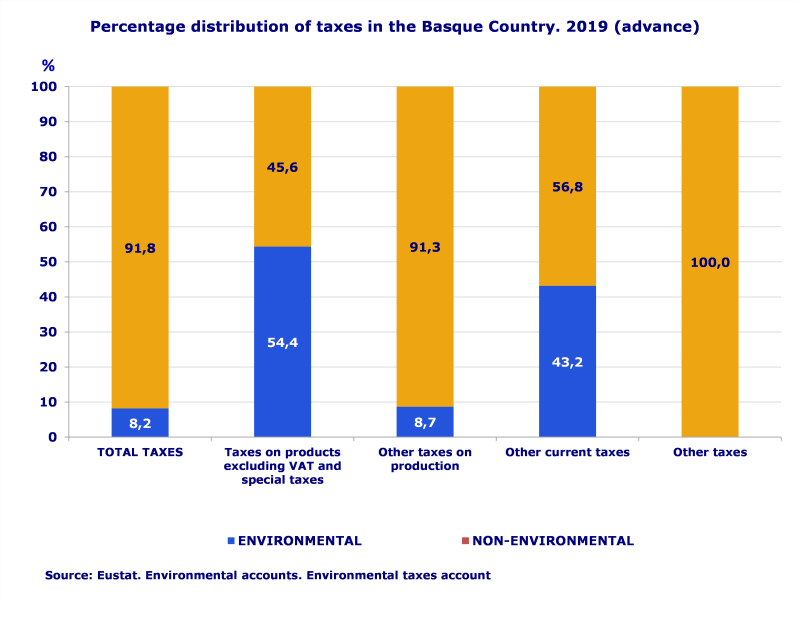

In relation to total taxes defined according to the SEC2010 national accounting system, Environmental taxes accounted for 8.2% of total taxes in the Basque Country in 2019, which was 0.6 percentage points more than in 2018 (7.6%). As regards classification by type of tax, most taxes of an environmental nature were concentrated in Taxes on products, excluding VAT and taxes on imports; in 2019, 54.4% of taxes recorded in this type corresponded to environmental taxes, reaching 1,201 million euros.

Within Other current taxes, environmental taxes represented 43.2%, reaching 139 million euros and within Other taxes on production, 8.7% corresponded to environmental taxes, accounting for 59 million euros.

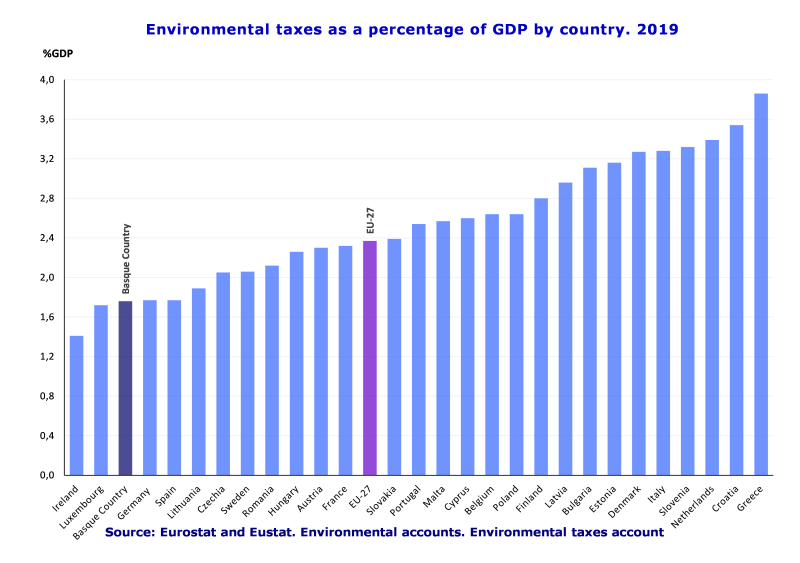

In relation to GDP, in 2019 environmental taxes in the Basque Country accounted for 1.76%, below the 2.37% of the average in the European Union (27 countries from 2020), a similar level to the 1.77% of Spain and Germany and above Ireland (1.41%) and Luxembourg (1.72%), according to the latest data published by Eustat.

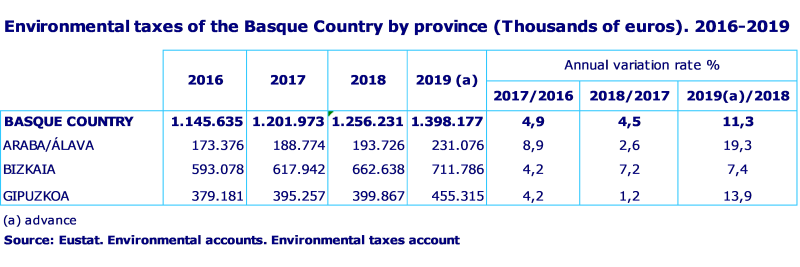

Analysing the distribution of environmental taxes by province for 2019, Bizkaia accumulated 50.9% of the total, Gipuzkoa 32.6% and Álava accounted for the remaining 16.5%.

For further information:

Eustat - Euskal Estatistika Erakundea / Basque Statistics Institute

C/ Donostia-San Sebastián, 1 01010 Vitoria-Gasteiz

Press Service: servicioprensa@eustat.es Tel: 945 01 75 62