Press release 05/06/2020

QUARTERLY ACCOUNTS. I/2020

The GDP of the Basque Country shrank by 3.2% in the first quarter of 2020

The fall in employment, in terms of full-time equivalent jobs, is estimated at 2.8%

The GDP of the Basque Country shrank 3.2% in the fourth quarter of 2020, compared to the same quarter of 2019, according to estimates made by Eustat.

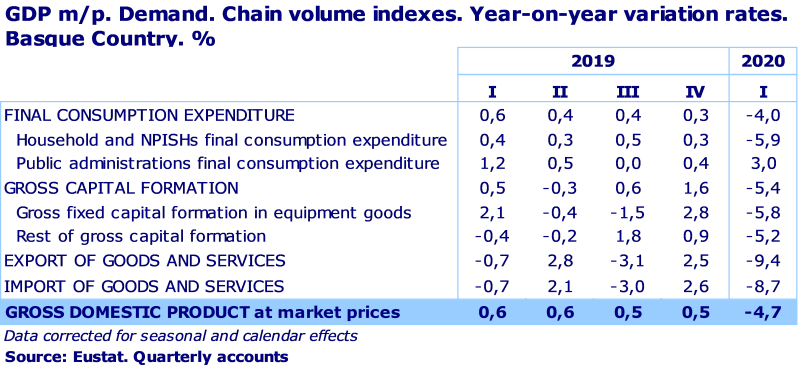

Compared to the last quarter of 2019, the economy of the Basque Country has decreased by 4.7%. These estimates are two tenths down on those obtained in the Advance Quarterly Accounts of 24 April. The measures adopted following Royal Decree 463/2020, of 14 March in response to the COVID-19 pandemic, brought the majority of activities of economic agents to a partial or total standstill during the second two weeks of March, making predictions difficult and complex estimations were made throughout April.

The year-on-year 3.2% drop in the GDP of the Basque Country coincides with the last estimate for the Euro-19 zone, although it is below that observed for the EU-27 as a whole (-2.6%), but above Spain, where it fell by 4.1%.

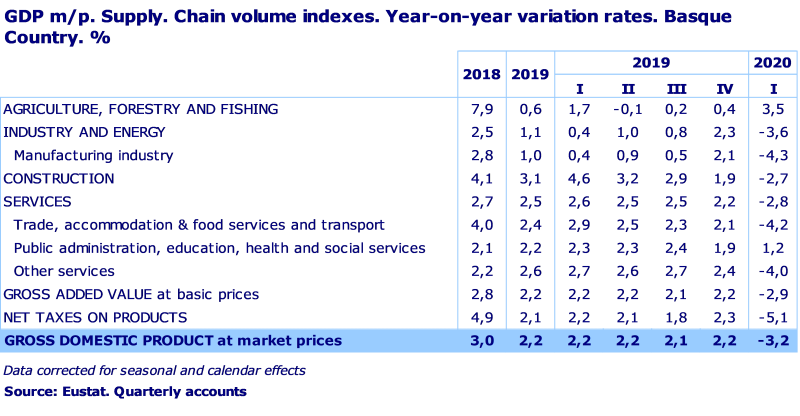

From the point of view of supply, all sectors experienced a year-on-year decrease in their value added, except in the case of Agriculture, Livestock and Fishing and in the Services sector branch of Public Administration, Education, Health and Social Services. In all cases, the sustained growth observed in recent years underwent a sudden downturn.

The Industry sector registered a negative year-on-year variation rate of -3.6% compared to the same quarter of the previous year. Compared to the last quarter of 2019, the estimated variation is -4.9%. Manufacturing Industry shrank faster than Industry as a whole, with estimated year-on-year and quarter-on quarter rates of -4.3% and -5.2%, respectively.

In the Construction sector a drop of 2.7% was observed in the first quarter of the year in respect of the same quarter of 2019, which implies a reduction in activity of 4.9% in relation to the previous quarter.

Global activity within the Services sector in the last quarter of the year broke with the growth trend observed in previous quarters, with a year-on-year decrease of 2.8%, which represented a fall of 4.2% in respect of the last quarter of 2019.

The performance of the Services sector varied by branches. The highest decrease was in the Trade, Hotel Management & Catering and Transport branch, down 4.2% compared to the same quarter of the previous year, and 5.7% in respect of the previous quarter.

In contrast, the branch of Public Administration, Education, Health and Social Services saw year-on-year growth of 1.2%, which represented an estimated value added identical to that obtained for the previous quarter (0% variation).

Finally, the activities included in the Other Services branch; which includes property, professional, scientific and technical, and financial and insurance activities; as a whole also saw a notable downturn, estimated at 4.0% in year-on-year terms and 5.4% in quarter-on-quarter terms.

The aggregated performance by sector in the first quarter of the year has given rise to a downward trend in Value Added, both in year-on-year (down 2.9%) and quarter-on-quarter terms (a drop of 4.4%), which contrasts with the continued positive values observed in recent years.

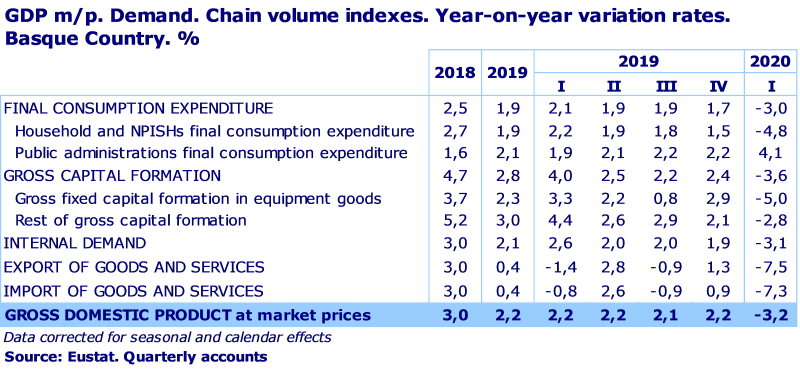

From the point of view of Demand, the performance of Internal Demand was almost equally negative to that of GDP, with a year-on-year reduction of 3.1%. The evolution of its two components, Final Consumption Expenditure and Gross Capital Formation, was negative, with year-on-year decreases of 3.0% and 3.6%, respectively.

Final Consumption Expenditure of Households and Non-profit Institutions Servicing Households (ISFLSH) (Private Consumption) shrank suddenly by 4.8% in relation to the first quarter of 2019. Compared to the previous quarter, there was an even more abrupt drop of 5.9%.

In contrast, Public Consumption (Final Consumption Expenditure of Public Administrations), posted growth of 4.1% in year-on-year terms, which was a 3.0% increase compared to the previous quarter.

The overall performance of Final Consumption Expenditure of Public Administrations together with Final Consumption Expenditure of Households led to a drop of 3.0% in Final Consumption Expenditure. Comparted to the previous quarter, expenditure contracted by 4.0%.

Gross Capital Formation (Investment) also saw a negative change, with a year-on-year variation rate of -3.6% in the first quarter of 2020. In relation to the last quarter of 2019, the decrease was 5.4%.

The performance of Investment in Capital Goods showed a markedly negative trend in this first quarter, with a year-on-year downturn of 5.0% and a quarter-on-quarter rate of -5.8%. In Other Gross Capital Formation, which is more closely linked to the performance of construction, the year-on-year decrease was more restrained, with a variation rate of -2.8%, although there was also a sharp drop in relation to the first quarter, with a quarter-on-quarter rate of -5.2%.

Internal Demand, composed of Final Consumption Expenditure and Gross Capital Formation, posted a negative variation in year-on-year terms of -3.1%. This decrease was slightly below that estimated for GDP (-3.2%), for which the contribution of the Foreign Sector was negative in this first quarter of the year. Exports were down 7.5% compared to the first quarter of the previous year, whilst Imports decreased slightly less, by 7.3%. There was therefore a slight fall in the foreign balance.

In relation to employment (measured in full-time equivalent jobs), the first quarter of 2020 was down 2.8% in year-on-year terms, in this case mitigating the decrease estimated at three tenths in the Advance Quarterly Accounts of 24 April. In quarter-on-quarter terms the decrease was estimated at 3.8%. These downturns observed in the first quarter are also the most significant of all the quarters estimated by Eustat to date in the quarterly Accounts.

In this regard, it should be remembered that the definition of a job, according to the European System of Accounts (ESA), excludes persons temporarily not at work but who have a formal attachment to their job, for example, an assurance of return to work or an agreement as to the date of return, as is the case with ERTEs (Temporary Labour Force Adjustment Plans).

The year-on-year evolution of employment levels was negative in all branches of activity in both year-on-year and quarter-on-quarter terms. The primary sector saw a 1.4% drop in employment in relation to the first quarter of 2019 and was down 1.7% compared to the previous quarter. The year-on-year decrease in both the Industry and Construction sectors was 3.4%, although in quarter-on-quarter terms Industry (-3.5%) performed better than Construction (-5.4%). Finally, in the Services sector, the evolution of jobs was also negative, with a year-on-year decrease of 2.7% and a quarter-on-quarter drop of 3.8%.

In terms of the variation in GDP by Province, Álava posted a year-on-year rate of -3.3%; Bizkaia of -3.2%, and Gipuzkoa of -3.1%.

For further information:

Eustat - Euskal Estatistika Erakundea / Basque Statistics Institute

C/ Donostia-San Sebastián, 1 01010 Vitoria-Gasteiz

Press Service: servicioprensa@eustat.es Tel: 945 01 75 62