Press release 21/01/2020

Exports of goods from the Basque Country began picking up in November 2019 with 12.5% growth

Exports of non-energy products increased by 16.2%, and those of energy products were down 23.2%.

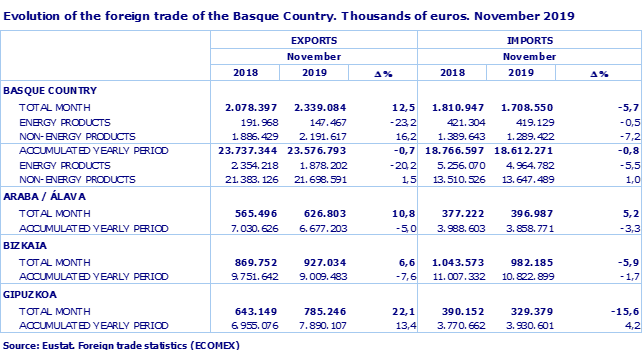

In November 2019 there was a 12.5% increase in exports of goods from the Basque Country, in year-on-year terms, according to EUSTAT data. They totalled 2,339 million euros compared to 2,078 million in the same month of the previous year. Exports of Energy products decreased by 23.2% and exports of Non-energy product were up 16.2%.

Gipuzkoa is the province that registered the best performance, with an increase in exports of 22.1%; in Álava exports increased by 10.8%, and in Bizkaia they were up 6.6%.

Imports of goods to the Basque Country experienced a drop of 5.7%, with a total of almost 1,709 million euros. Both energy and non-energy imports were down, by 0.5% and 7.2%, respectively.

At provincial level, in Álava imports grew by 5.2%, whereas in Bizkaia they were down 5.9%, and in Gipuzkoa they fell by 15.6%.

Analysing exports by branches of activity (A86), this month there were decreases in the five largest: Motor vehicles rose by 9.6% (501 million), General Use Machinery was up 14.1% (247 million), Other Transport material increased by 183.6% (226 million), Non-Ferrous Metals by 178.9% (203 million) and Metal Products by 5.5% (157 million).

In contrast, it should be pointed out that there were decreases in the traditionally important branches of activity such as Coke Plants & Oil Refining (123 million and down 6.9%) and Iron and Steel Products (196 million and a drop of 14.9%)

A more detailed look reveals that in November the ten main export duty groups accounted for 46.6% of exports, with a combined value of 1,091.2 million euros. Amongst these, due to their growth, the following all stood out: Passenger cars with fewer than 10 seats (33.4%), Refined Petroleum Oils (5.8%), Goods Transport Vehicles (17.7%), Unrefined copper and copper anodes for electrolytic refining (711.7%) and, in particular, Diesel and electric motor units for railway tracks and motorised trams(1,604.0%); in contrast, there were decreases in Vehicle Parts and Accessories (-13.3%), New rubber tyres (-15.7%), and also Iron or non-alloy steel section(-6.1%).

This month ten countries - Germany, France, the United Kingdom, Belgium, the United States, Italy, Portugal, the Netherlands, Chin and Poland - accounted for 70.3% of our exports. Only two do not belong to the EU-28, which with 1,623.7 million, accounted for 69.4% of Basque Country exports.

Analysing imports by branches of activity (A86) reveals that the largest, Extraction and Petroleum Industries (21.4% of the total), saw a drop of 10.4%. There was also a decrease in imports of Iron and Steel products (-20.9%), whereas there was a rise in imports of Motor vehicles (14.6%) and General Use Machinery (10.5%).

ACCUMULATED FIGURES FOR THE FIRST ELEVEN MONTHS OF 2019

Foreign trade in goods from the Basque Country during the first eleven months of 2019 had a positive balance of almost 5,000 million euros

For the first eleven months as a whole, Basque Country exports registered a decrease of 0.7%, which translates to a difference of 160.6 million compared to the same period of the previous year.

Exports from Bizkaia, with an accumulated total of 9,009.5 million euros, dropped by 7.6%. In Álava exports fell by 5.0% whereas in Gipuzkoa they rose by 13.4%.

Taking into account the type of product, the aforementioned decrease (-20.2%) was concentrated in Energy Products, with a drop of 476.0 million euros.

Seven out of the existing 48 branches of activity accounted for 68.8% of exports over these eleven months, with variable performance; whilst there was an increase in General use machinery (2.5%) and Other transport material (126.8%), there were decreases in Motor vehicles, which fell by 8.1%, Iron & Steel Products (-11.3%), Metal Products (-5.2%), and Coke Plants & Oil Refining (-23.1%).

The export ranking situated France as the prime receiver country of Basque exports, with 15.4% of the total exported (3,632.2 million). After France came Germany, also with 15.4% (3,630.5 million), the United Kingdom (9.4%) and the United States (7.0%). Between them, these four countries accounted for 47.2% of Basque exports.

Accumulated imports for the Basque Country as a whole amounted to 18,612.3 million euros. Comparing this figure in year-on-year terms we see that it represents 154.3 million less (-0.8%) than that registered in the same period of 2018. Imports of Energy Products fell by 5.5% and those of Non-energy Products rose by 1.0%.

48.4% of imports were concentrated in four branches of activity. The first three accumulated figures below those registered in the same period of the previous year. Thus, Extraction and Petroleum Industries, which is the largest branch (4,456.0 million), fell by 11.4%, Iron & Steel Products (1,678.1 million) was down 4.2% and Motor Vehicles (1,515.7 million) dropped by 5.5%, whereas General Use Machinery was up 4.3%.

Foreign trade in goods in the Basque Country during the first eleven months of 2019 had a positive balance of 4,964.5 million euros, which represents a coverage rate of 126.7%.

MINERAL FUELS IN THE BASQUE COUNTRY (customs duty chapter 27)

Customs Duty Chapter 27in the “Combined Nomenclature” published by EUROSTAT is headed “Mineral fuels, mineral oils and products of their distillation; bituminous substances; mineral waxes.” Coming under this heading are a series of products including:

Coal

Tars, pitches, crude oil

Oil distillates

Gaseous Hydrocarbons

Lubricating oils, paraffins, petroleum jellies etc.

Electricity, Gas & Steam

During 2018 this customs duty group accounted for 10.7% of Basque Country exports and 28.0% of imports. From January to November 2019 these percentages stood at 8.0% and 26.7% respectively. Over the last 30 years the average of these trade flows has been 7.3% and 24.6%. As a consequence of the aforementioned percentages, in 2018 there was a net trade deficit of 2,962 million euros.

Exports of products pertaining to this chapter have traditionally centred on Refined petroleum oils, which during 2018 accounted for 72.0% of the chapter (its historic average has been 86.2%) and until November in 2019 had reached 70.7%.

An in-depth analysis of this type of product (1,993.7 million in 2018) reveals that we have mainly exported:

95 octane petrol (863.2 million)

Other light oils (402.2 million)

Other special lubricating oils (209.8 million)

Low-sulphur diesel < o = 0.001% by weight (166.7 million)

High sulphur fuel > 1% by weight (137.1 million)

Diesel with a sulphur content > 0.002 % and o = 0.1 % by weight (101.3 million)

Outside of this product we have also exported Naphthalene (272.4 million), Special propanes (120.9 million), Petroleum oils or oils obtained from bituminous minerals (110.5 million) and Bitumen (109.0 million).

Basque exports of these types of products has traditionally been concentrated amongst a limited group of countries. Leading this, and with a noteworthy advantage over the other countries, is the United States, which has always occupied one of the three first positions in the export ranking, and has led for 21 years. Since 2000 over 25% of mineral fuel exports have gone to this country (between 2005 and 2009 the figure stood at 41%). IN 2018 it once more occupied first place with a total of 818 million euros; however, in 2019 up to November (463 million) it was overtaken by France (532 million). The type of product mainly exported to the United States in 2018 was 95 octane petrol (776.5 million) and for what we have seen of 2019 so far, as well as this type of petrol (193.8 million), a type of Petrol under 95 octane (210.1 million) has also been exported.

France is traditionally positioned after the United States (476.3 million in 2018). In this case there is a greater diversity in terms of the type of product exported; thus, Low-sulphur diesel < o = 0.001% by weight stood for 104.9 million, followed by Calcined petroleum coke with 102.6 million and Other special lubricating oils with 87.9 million. The Netherlands then follows (662.9 million in 2018) with products such as Other light oils (154.5 million), Naphthalene (121.2 million) and Propane with a purity below 90% (98.3 million). Belgium appears below, fundamentally with two products: Other light oils (144.5 million) and Naphthalene (133.5 million). Portugal also normally appears among the first positions (135.8 million in 2018) with products such as Low-sulphur diesel (41.2 million) and Petroleum oils or oils obtained from bituminous minerals (40.7 million). Lastly, particularly worth of mention are the significant exports destined for Gibraltar of High sulphur fuel > 1% in weight (21.1 million) and Sulphur fuel >0.1% and < o = 1% in weight (10.3 million) and those traditionally sent to Morocco.

In the case of imports, these types of product also account for a high percentage, nearing 25% (average 24.6%) and above 32% for the years 2008 and 2014. In 2018, the last complete year for which data are available, this percentage stood at 28%.

These imports are particularly concentrated around a single product, Crude petroleum oils (4,768.1 million in 2018), which have always supposed over 53% of the total of this customs duty group with an average of 71.2% over the last 30 years and representing 83.2 of group 27 in 2018. As well as this type of product, Natural gas (558.5 million) and Low-sulphur diesel < 0 = 0.001% in weight (155.9 million) are also imported.

Four countries have traditionally been our suppliers for these types of product. Over the last 28 years (average of 24%) Russia has been the source for the majority of imported “crude” and, on occasions, natural gas, occupying first place in the importer ranking for 20 years. The exception was 2018 when it occupied seventh place with 248.4 million. However, for 2019 so far, it again occupies first place with an accumulation to November of 952.4 millions, of which 286.7 were Natural gas. In second place for this type of product was Mexico, with a total fo 879.2 million for 2018 and 675.3 up to November 2019. The United Kingdom has also featured among the first positions in the ranking for many years. Nevertheless, with just 208 million in 2018 it was relegated to tenth position and for 2019 so far it is in eleventh. Likewise, Nigeria has always been amongst the leaders in the ranking and in 2018 occupied third place with 542 million. Lastly, a fifth country, Libya, has undergone a resurgence as an importer from 2017, occupying second place in 2018 with 824 million, and third in 2019 with an accumulation of 574.3 million.

For further information:

Eustat - Euskal Estatistika Erakundea / Basque Statistics Institute

C/ Donostia-San Sebastián, 1 01010 Vitoria-Gasteiz

Press Service: servicioprensa@eustat.es Tel: 945 01 75 62