Press Release 23/01/2018

ENVIRONMENTAL ACCOUNTS ENVIRONMENTAL TAXES ACCOUNT 2016 (a)

In 2016 environmental taxes in the Basque Country stood at 1,194 million euros

This figure represented 8.1% of total taxes in the Basque Country

Environmental taxes in the Basque Country stood at 1,194 million euros in 2016, 3.1% higher than the previous year, according to the Environmental Taxes account prepared for the first time by Eustat.

Environmental taxes are defined by EUROSTAT as those whose tax base is a physical unit (or a proxy of it) of something that has a proven, specific negative impact on the environment and which is defined in the European System of Accounts (ESA 2010) as a tax.

Environmental taxes are grouped into three categories: Taxes on energy Taxes on transport and taxes on pollution and resources.

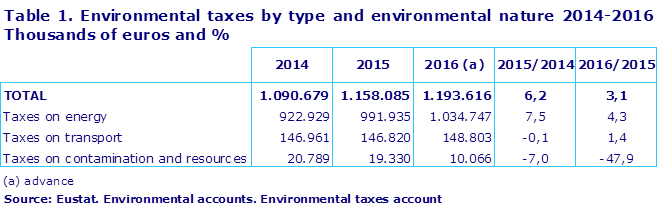

Following these groupings, taxes on energy are the largest, representing 86.7% of the total, and are those that grew the most in both 2015 (7.5%) and in 2016 (4.3%).

In second place are taxes on transport, 12.5% of the total, which grew at a rate of 1.4% in 2016.

Finally, taxes on pollution and resources, which represented a marginal amount account for the remaining 0.8% and registered a decrease of 47.9% on the previous year.

Within taxes on energy, the most significant is the special tax of hydrocarbons, which in 2016 represented 86.1% of taxes on energy. The second, in order of importance, is the special tax on electricity, representing 6.5%.

With regards to taxes on transport, of particular note is the tax on mechanical traction vehicles, which represented 88.0% of environmental taxes on transport in 2016.

In turn, with regards to taxes on pollution and resources, the fees for utilising continental waters for electricity production stand out (although with a much more limited weight in total taxes), with a weight of 57.1%.

In terms of GDP, environmental taxes accounted for 1.68%, below the 1.85% estimated for Spain, and the 2.44% of the European Union 28.

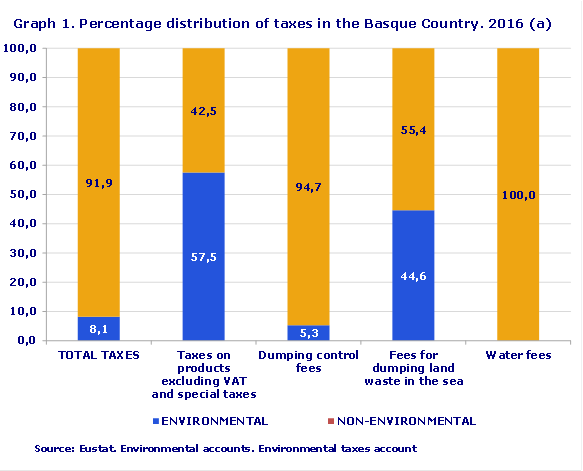

In relation to total taxes, this figure represented 8.1% of total taxes in the Basque Country and in Spain this ratio rose to 8.4%.

As for the classification of taxes in the national accounting system, most taxes of an environmental nature are concentrated in Taxes on products, excluding VAT and taxes on imports: in 2016 57.5% of the total were taxes of an environmental nature, reaching 1,033 million euros, which also represented 86.6% of total environmental taxes in 2016.

Within Other current taxes, taxes with an environmental objective represented 44.6% of the total, 131 million euros in 2016, and 5.3% of Other taxes on production, almost 29 million euros.

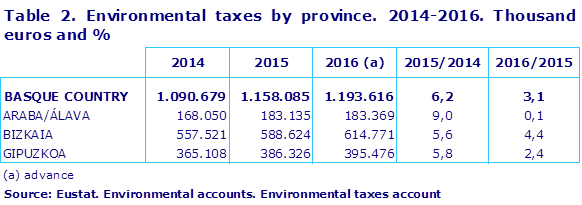

Analysing the data for environmental taxes by province, Álava represented 15.4% with growth of 0.1% on the previous year, Bizkaia 51.5% with 4.4% growth and Gipuzkoa 33.1%, growing by 2.4%.

For further information:

Eustat - Euskal Estatistika Erakundea / Instituto Vasco de Estadística

C/ Donostia-San Sebastián, 1 01010 Vitoria-Gasteiz

Press Service: servicioprensa@eustat.eus Tlf: 945 01 75 62