Press release 31/10/2016

The debt of non-financial companies in the Basque Country has decreased by eight percentage points in the last five years

Financial profitability has increased, with small and medium sized companies and non-financial services standing out

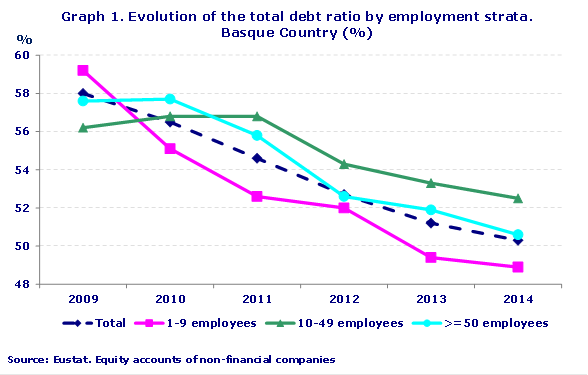

Total Debt, a ratio that shows the relationship between external funds and total equity, stood at 50.3% in 2014, for all non-financial companies in the Basque Country, according to data prepared by EUSTAT, a decrease of 8 percentage points on 2009. This ratio shows that just over half of the assets are financed using borrowings.

The decrease achieved in the stratum of large companies (over 249 employees) is significant – 2.9 percentage points – with a debt ratio of 45.9% in 2014. Microenterprises (fewer than 10 employees) and small companies (10 to 49 employees) also saw a decrease of 0.5 and 0.8 percentage points respectively, with the debt ratios at 48.9% and 52.5% respectively. The medium companies stratum (50 to 249 employees) is the only one whose debt ratio has grown compared to 2013, standing at 56.3%, 1.1 points higher than the previous year.

By major sector, Construction posted a debt ratio of 61.3%, Industry 49.3% and Market Services 48.8%. In a more detailed analysis, the sectors of Other Personal Services(1) and Hotel Management & Catering stand out, with debt levels of 77.3% and 73.2% respectively. At the opposite extreme was the sector of Water Supply, Purification and Waste & Decontamination Management, with a ratio of 32.8%.

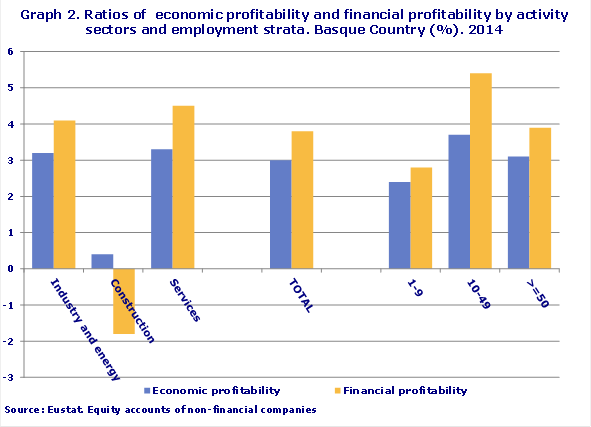

Financial Profitability , which provides information on the average profit obtained by companies from its activities, based on net assets, stood at 3.8% in 2014, 0.5 percent higher than in the previous year. Small and medium companies are those with the best ratio (5.4% and 6.6% respectively). Large companies obtained the lowest (2.2%). By major sector, Construction posted a profitability ratio of 1.8% in 2014, Market Services achieved the best result with 4.5% and Industry obtained 4.1%.

The Economic Profitability ratio was 3.0% in 2014 and it gives the companies' average performance as a percentage of their total assets. This ratio performed positively for companies as a whole, rising from 2.8% in 2013 to 3.0% in 2014. By employment strata, it was medium-sized companies that had a higher profitability ratio, at 4.0%. On the other hand, microenterprises and large companies, both with a ratio of 2.4%, had the lowest economic profitability. The profitability of the Telecommunications sector stood out positively, with a ratio of 6.5%; whereas the ratio of the Other Personal Services sector was notably poor, at -1.1%.

Financial Leverage, which analyses the impact of the financial structure of the company on its financial profitability, was positive for all employment strata and for the main activity sectors except Construction.

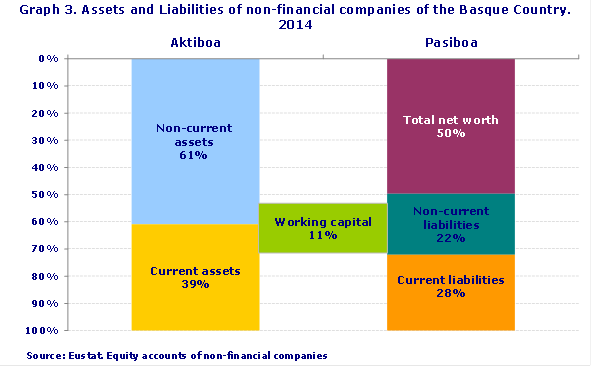

Estimated assets for non-financial companies as a whole in the Basque Country in 2014 were up 0.1% on the previous year and amounted to EUR 197.780 billion. Large companies of more than 250 employees were the most capital intensive in 2014, given that they accounted for 21.1% of the total assets of the economy with 12.5% of employment in that year. Microenterprises owned 39.8% of company assets with 43.0% of the staff employed. The rest, companies with 10 to 249 employees, held 39.1% of the assets and 44.5% of employed personnel.

In the distribution of assets by sector, the importance of Industry was made clear within the economy of the Basque Country. Thus, 39.9% of assets corresponded to the Industrial sector, which generated 26.8% of employment, although it was Market Services that generated the greatest percentages, with 49.1% of equity and 64.8% of employment. Lastly, Construction had 11.0% of assets and 8.4% of employment.

The positive difference between Current Assets and Current Liabilities, Working Capital, stands at EUR 22,384 million (11.3% of total assets), and is up 4.5% on 2013. This means that sufficient funds have been earned to cover specific short-term debts (payable in the short term), to a greater degree than in the previous year. However, as a result of the different balance sheet structures by business sectors, the working capital of companies in the Construction sector accounted for 30.3% of its assets, whilst this figure stood at 8.3% for the Industrial sector and 9.5% for the Market Services sector.

Note: (1) This sector includes certain types of services such as laundrettes, hairdressers, funeral directors and others

For further information:

Eustat - Euskal Estatistika Erakundea / Instituto Vasco de Estadística

C/ Donostia-San Sebastián, 1 01010 Vitoria-Gasteiz

Press Service: servicioprensa@eustat.es Tlf: 945 01 75 62

More press releases on CPENF - Equity Accounts of Non-Financial Companies

Databank on Equity Accounts of Non-Financial Companies