Press Release 25/11/2013

Micro-companies account for 43.2% of corporate wealth in the Basque Country

In 2011 Basque companies debt fell and the consistency ratio was up. However profitability was down

Companies employing fewer than 10 workers, micro-companies, accounted for 43.2% of assets in the Basque Country in 2011, employing 42.9% of employed personnel, according to Eustat data. Small companies (10-49 employees) represented 20.6% of the total assets and employed 24.7% of personnel. 20.5% of employed personnel worked in medium-sized companies (50-249 employees), to which 17.3% of assets corresponded. The largest companies have remained the most capital intensive, with 11.8% of personnel employed and 18.9% of the economy's total assets.

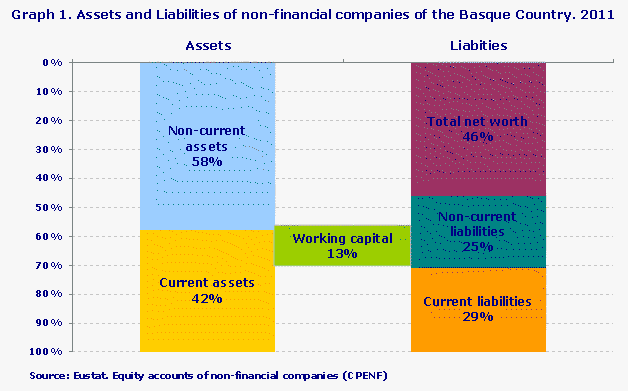

Estimated assets for non-financial companies as a whole in the Basque Country in 2011 were up 0.6% on 2010 and amounted to EUR 205,468 million.

The positive difference between Current Assets and Current Liabilities, Working capital, stands at EUR 26,854 million (13% of total assets), and is down 8.2% on 2010. This means that sufficient funds have been earned to cover specific short-term debts (payable in the short term), but to a lesser degree than in the previous year.

The analysis of other keyeconomic and financial ratios of Basque companies shows that the debt and financial structure ratios have improved but the profitability ratios have worsened.

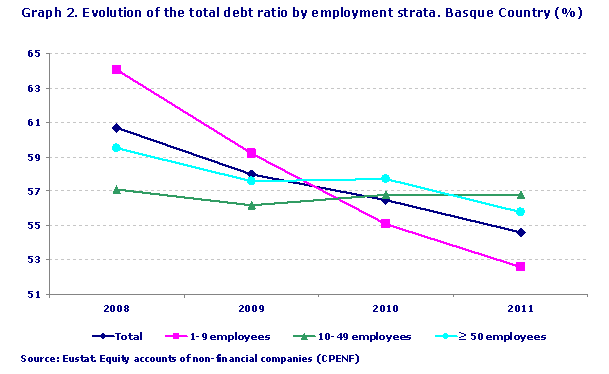

The total debt ratio shows the existing relationship between borrowings and total equity. The total debt ratio for the Basque Country is 54.6%. This ratio shows that just over half of the assets are financed using borrowings. Since 2008, this ratio has dropped 6.1 percentage points and is down 1.9 percentage points on the previous year. By employment strata, companies that employ between 10-49 people have a higher debt ratio in 2011 (56.8%) and have not recorded substantial differences during the period as a whole. Other companies have posted significant debt reductions, especially in the case of micro-companies, whose ratio has fallen 11.5 percentage points since 2008. By major sector, construction posted a debt ratio of 62.2% in 2011, industry 54% and market services 52.8%. A more detailed analysis shows that the Hotel Management and Catering industry has a debt level of 75.2%.

The Financial Autonomy ratio, which measures the financial dependency of companies on third parties (understood as the relation between net assets and other liabilities), stood at 83.2%, 6.1 points up on 2010. This autonomy was less prevalent in the construction sector, which had a ratio of 60.8%, with the industry and services sectors standing at 85.2% and 89.3%, respectively.

The consistency ratio, a reflection of the guarantee offered by companies to long-term creditors, was 227.4% in 2011 and ranged from 123.2% in the construction sector to 251.7% in the industrial sector, and 239.5% in the market services sector. It was up by 14.4 percentage points on 2010 for companies as a whole.

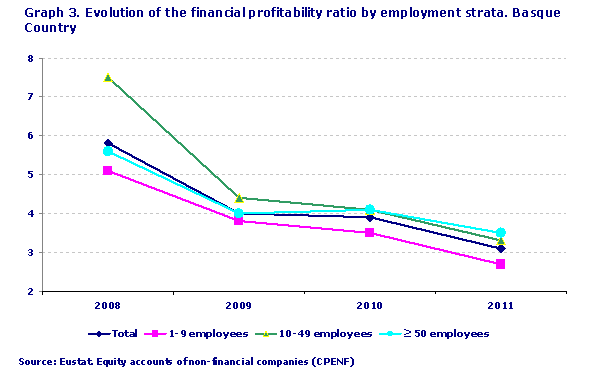

An analysis of the profitability ratios (economic profitability, financial profitability and financial leverage) highlighted 4 sectors, all industrial, that had improved their profitability levels with respect to the previous year: Wood, Paper and Graphic Arts, Metallurgy and Metal Products, Machinery and Equipment and Electricity, Gas and Steam.

�

The Economic profitability ratio was 3.1% in 2011 and it gave the average of companies as a percentage of their total assets. This ratio did not perform positively for companies as a whole, dropping from 5.8% in 2008 to 3.1% in 2011. In 2010 this figure fell by eight tenths. By employment strata, larger companies have a higher profitability ratio of 3.5%. Of all the sectors, only the Hotel, Management and Catering sector had a negative profitability ratio of -1.4%.

Financial profitability , which provides information on the average profit obtained by companies from its activities, based on net assets, stood at 3.9% in 2011, two percentage points lower than in 2010.

For further information:

Eustat - Euskal Estatistika Erakundea / Instituto Vasco de Estadística

C/ Donostia-San Sebastián, 1 01010 Vitoria-Gasteiz

Press Service: servicioprensa@eustat.eus Tlf: 945 01 75 62

More press releases on CPENF - Equity Accounts of Non-Financial Companies

Databank on Equity Accounts of Non-Financial Companies