Press Release 29/10/2012

Micro-companies generated 43% of employment and accounted for 41% of business equity in the Basque Country in 2010

44% of assets of non-financial companies belonged to the market services sector

The distribution of business equity amongst the different employment strata showed that 40.7% of it was held by micro-companies (1-9 employees), employing 43.0% of those in work, according to data compiled by Eustat. Small businesses (10-49 employees), for their part, accounting for 25.0% of employed individuals, held 21.2% of assets. Medium-sized companies (50-249 employees) accounted for 19.9% of employed individuals, representing 20.1% of equity and, lastly, large companies with 12.1% of employment accounted for 18.0% of the total assets in the economy.

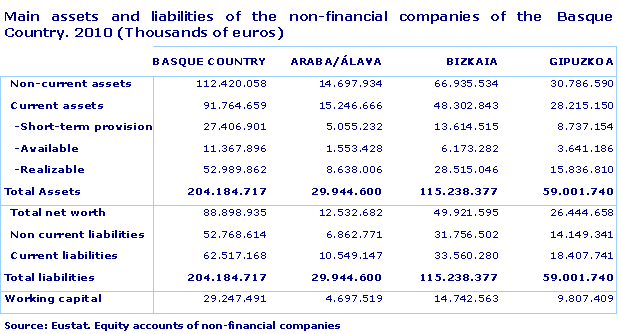

Estimated equity for all non-financial companies in the Basque Country stood at 204,185 million euros, 2.5% up on 2009, of which 44.1% belonged to the market services sector. 40.5% of the remaining assets were distributed amongst the industrial sector and 15.4% amongst the construction sector.

�

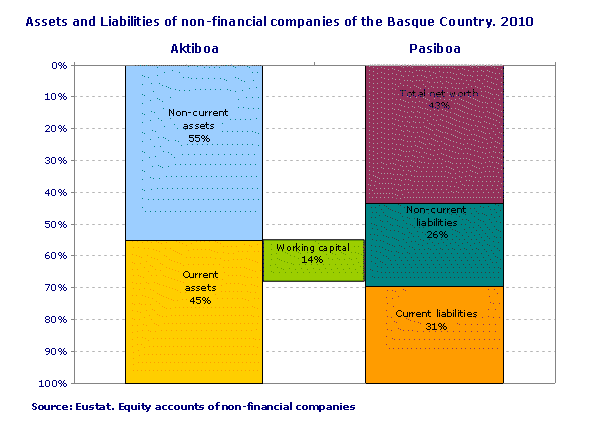

As regards the weight of the different entries under Assets of the balance sheet, Fixed Assets accounted for 55.1% of the total whilst Current Assets accounted for 44.9%. Under the headings that make up Fixed Assets, most notable in terms of importance were Tangible Fixed Assets (43.7%) and Investments in Group Companies and Affiliates (34.8%). There were also two items that stood out within Current Assets: Trade Debtors, which accounted for 35.3% of the total and Stock, accounting for 29.9%.

In relation to Net Equity and Balance SheetLiabilities, the share of their headings was as follows: Net Equity represented 43.6% of the total, Current Liabilities, 30.6% and Long-term Liabilities, 25.8%. With Net Equity, special mention should be made of Own Funds with two important headings: Reserves (46.9%) and Capital (31.2%).

With regards to the year-on-year variation of the main headings, on the one hand and within assets, both long-term assets and current assets stood out with growth of 3.1% and 1.8%, respectively. On the other side of the Balance sheet there were increases in Net Equity and Current Liabilities of 6.3% and 1.3% respectively, whereas Long-term assets were down 1.9%.

Differences can also be seen in the composition of company liabilities in the construction sector compared to those of industry and market services. The construction sector had Current Liabilities, associated with the short term, of 36.5%, whilst in the industrial sector they stood at 30.9% and in market services at 28.3%.

The Financial Autonomy ratio, which measures the financial dependency of companies on third parties (understood as the relation between net assets and other liabilities), stood at 77.1%, 4.7 points up on 2009. This autonomy was less prevalent in the construction sector, which had a ratio of 53.0%, with the industry and services sectors, standing at 77.6% and 86.9%, respectively.

�

Differences were also seen in the composition of business assets by sectors: current assets in the construction sector accounted for 69.3% of total assets, whereas they accounted for 42.0% in the industrial sector and 39.2% in the market services sector.

These differences in the composition of assets and liabilities had their corresponding effect on the diverse sectorial ratios. We can see in the Consistency Ratio, an indication of the guarantee that companies offer to creditors in the long-term, that it varied from 106.4% from the construction sector up to 241.4% from the market services sector, and 228.4% from the industrial sector.

In the analysis of the balance sheets, the Working Capital (difference between Current Assets and Current Liabilities) was positive, standing at 29,247 million euros (2.8% up on 2009), which meant that sufficient resources were generated to address short-term debts (due in the short term). However, as a result of the different balance sheet structures by business sectors, the working capital of companies in the construction sector accounted for 32.8% of its assets, whilst this figure stood at 11.1% for the industrial sector and 10.9% for the market services sector.

The Basic financial profitability offers information relating to the average profit made by the company during its activity, in relation to its net assets and non-current liabilities, and stood at 3.1%, similar to the 3.2% of the previous year. In the construction sector this ratio stood at 1.7% and in the market services sector it stood at 3.8%. In the industrial sector it stood at 2.9%.

�

�

�

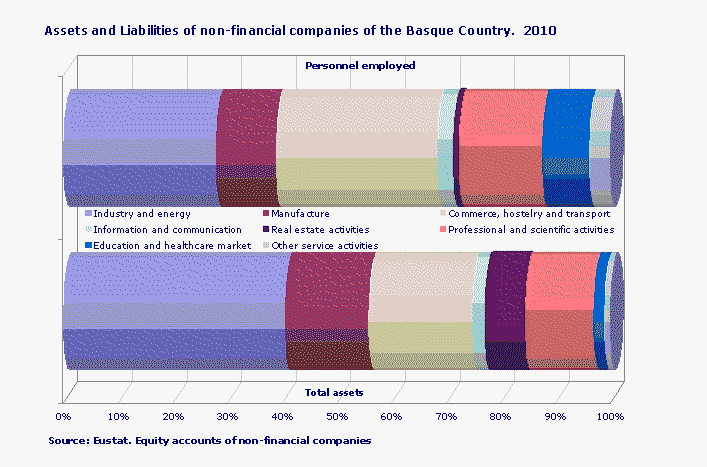

Looking at the sectorial analysis in greater detail, it can be observed how the Industry and Energy sector took 40.5% of company assets and 27.9% of employment. On the other hand the Trade, Hotel management and catering and transport sector represented 29.5% of employment and absorbed 18.9% of assets. Real Estate Activities, with 0.9% of employment, held 7.3% of company wealth. Market activities relating to Education and Health, with 8.6% of employed individuals, held 2.0% of assets.

For further information:

Basque Statistics Office

C/ Donostia-San Sebastián, 1 01010 Vitoria-Gasteiz

Tel: +34-945-01 75 00 Fax:+34-945-01 75 01 E-mail: eustat@eustat.eus

Contact: Patxi Garrido

Tel:+34-945-01 75 13 Fax:+34-945-01 75 01

More press releases on CPENF – Equity Accounts of Non-Financial Companies

Databank on Equity Accounts of Non-Financial Companies