Press release 15/02/2010

The GDP for the Basque Country posted a year-on-year downturn of 2.5% in the fourth quarter of 2009

Growth was positive compared to the previous quarter and stood at 0.2%

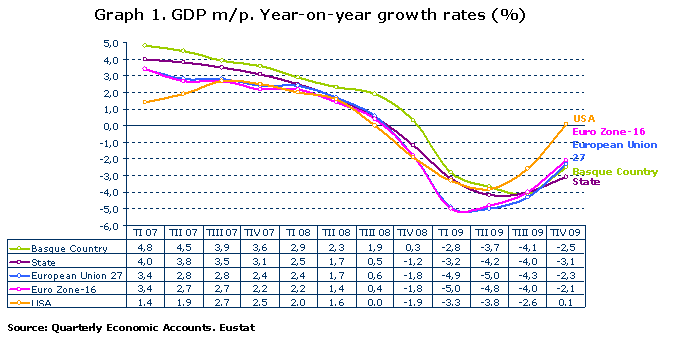

GDP created by economic activity in the Basque Country registered a decrease of 2.5% in the fourth quarter of 2009, compared to the same period of 2008, according to EUSTAT data. This rate was up 1.6 points with respect to the previous quarter.

This figure was -3.1% for the Spanish economy, -2,3% for the EU-27 overall, -2,1% for the Euro-16 zone and 0,1% for the US economy.

With respect to the previous quarter, the GDP of the Basque Country registered positive growth of 0.2%, which was the first positive quarter-on-quarter data after four consecutive quarters with negative rates. This quarter-on-quarter variation was -0.1% in the case of the Spanish economy, -0,1% for the EU-27, 0,1% for the Euro-16 Zone and 1,4% for the US economy.

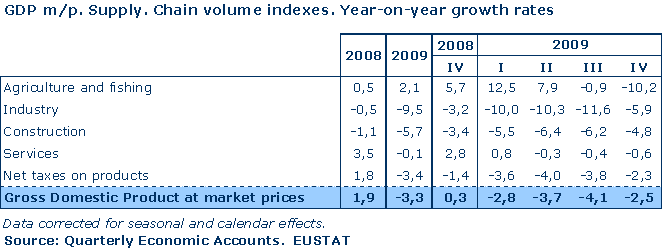

From the point of view of supply, all the sectors posted negative year-on-year increases, but they all, with the exception of Construction, posted positive growth rates with respect to the previous quarter. The better performance of the industrial and, above all, of the service sectors explains the improvement in the overall evolution of the GDP in terms of supply.

�

The primary sector fell by 10.2% with respect to the same quarter of 2008 and posted a positive quarter-on-quarter performance of 2.4%.

After a year of a steady fall in its year-on-year growth rates, the industrial sector again posted negative growth in this quarter, although at a more moderate rate (-5.9%)- This performance has to be combined with a positive quarter-on-quarter growth rate of 0.5%, after four consecutive downward quarters.

The Construction sector continued to post year-on-year and quarter-on-quarter negative rates. Its year-on-year negative performance (-4.8%) was 1.4 points better than the rate for the previous quarter (-6.2%), but not enough to improve the quarter-on-quarter rate. This quarter-on-quarter fall stood at 0.7%, which was also 0.2 of a percentage point up on the rate for the previous quarter.

The overall performance of the Service sector combined a negative year-on-year rate of 0.6% with a positive quarter-on-quarter rate of 0.3%. There was a substantial change in the performance of its two components with respect to the previous quarters. The Market Service saw a 0.6 improvement, despite a year-on-year fall of 1.1%. On the other hand, the Non-Market Service went from year-on-year growth rates approaching or even over 6% to posting a year-on-year growth rate of 1.8% for the last quarter. The quarter-on-quarter rate was also negative (-0.9%) for the first time in the year.

�

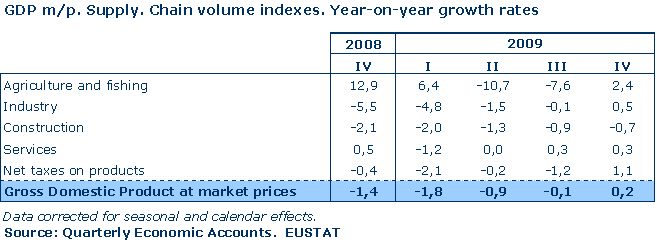

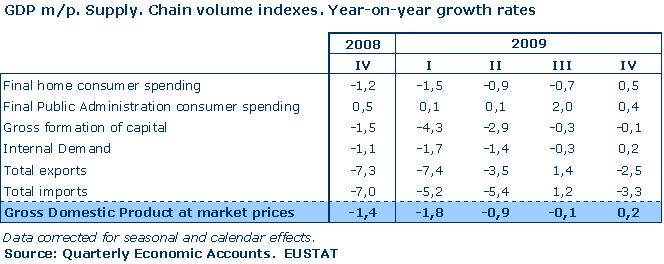

The performance when it came to Demand can be summarised by a shrinking of Internal Demand (-3.2% year-on-year) and the positive contribution of the foreign trade sector. However, the drop in Internal Demand was 1.3 points less than for the previous quarter, which resulted in a positive quarter-on-quarter growth rate of 0.2% for the first time and after six consecutive negative quarters.

Expenditure on Household Final Consumption (Private Consumption) showed signs of recovery in this quarter, with a year-on-year 2.6% fall that was more moderate than the previous quarter. After five quarters of negative quarter-on-quarter rates, Household Consumption also posted positive growth of 0.5% compared to the previous quarter, which explains the positive quarter-on-quarter performance of the GDP by Demand.

The growth of Public Consumption, even though it posted positive rates (2.5% year-on-year and 0.4% quarter-on-quarter), slowed down with respect to previous quarters.

The performance of the Gross Capital Formation (Investment) is determined by the Construction and Capital Goods sectors. The weakness seen in previous periods remained in both cases, which led to year-on-year (-7.5%) and quarter-on-quarter (-0.1%) negative growth rates, even though they were better in previous quarter.

�

The foreign trade balance positively contributed to the growth of GDP, mainly due to the greater fall in imports (-12.1%) than in exports (-11.7%), although both were more moderate than in previous quarters.

The number of people employed was up by 0.3% on the previous quarter, even though it was 3.1% down on the same period 2008. This means around two thousand seven hundred net jobs were created with respect to the average for the previous quarter, although over thirty thousand jobs were lost in relation to the same quarter of the previous year. The increase in jobs in this quarter with respect to the previous one was mainly in the Service sector, while Industry and Construction continued to loose net jobs.

With reference to the evolution of the GDP by province, during this fourth quarter of 2009, the year-on-year rates for Alava and Bizkaia fell by 2.7% while it was down by 2.1% in Gipuzkoa. In terms of quarter-on-quarter rates, Alava posted the best performance, with growth of 0.9%, while both Bizkaia and Gipuzkoa grew by 0.2%.

The GDP fell by 3.3% for the year as a whole and over 36,000 jobs were lost

In terms of supply, Industry, with a fall of 9.5%, and Construction, down by 5.7%, were the sectors that most determined the overall performance of the GDP. In 2009 overall, the Service Sector performed in two different ways, as Non-market Services, linked to the Public Administration, grew by 4.9%, while Market Service fell by 1.2%. The Service sector overall dropped by 0.1%. The Primary sector posted growth of 2.1% overall for the year.

The analysis of expenditure indicates that there was a 4% drop in Internal Demand, compared to a fall in the GDP of 3.3%, which meant that the foreign trade balance made a positive contribution for the year overall.

The downturns in Household Final Consumption Expenditure (-3.8%) and the Gross Capital Training (-8.3%), together with a positive performance by Final Consumption Expenditure by the Public Administration (3.2%) have determined the evolution of Internal Demand.

The number of people employed fell by 3.5% on average, with the losses being across the sector, but was particularly high in Industry (-6.7%) and in Construction (-9.9%).

For further information:

Basque Statistics Office

C/ Donostia-San Sebastián, 1 01010 Vitoria-Gasteiz

Tlf:+34-945-01 75 00 Fax:+34-945-01 75 01 E-mail: eustat@eustat.es

Contact: Javier Aramburu

Tlf:+34-945-01 75 99 Fax:+34-945-01 75 01

Online press releases: www.eustat.es

Databank: www.eustat.eus/bancopx/english/indice.aspx